Filing of business personal property returns collection of the business personal property tax. Clarke county collects on average 054 of a propertys assessed fair market value as property tax.

Clarke County Virginia Personal Property Tax Lists Volume 1

Clarke County Virginia Personal Property Tax Lists Volume 1

clarke county va personal property tax

clarke county va personal property tax is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in clarke county va personal property tax content depends on the source site. We hope you do not use it for commercial purposes.

Please remember the responsibility of keeping the assessor informed of any changes to the business address mailing address.

Clarke county va personal property tax. In the case of personal property tax. Treasurer tax collector offices in clarke county va are responsible for the financial management of government funds processing and issuing clarke county tax bills and the collection of clarke county personal and real property taxes. Clarke county collects relatively high property taxes and is ranked in the top half of all counties in the united states by property tax collections.

The countys history began long before alabamas statehood. There are three major roles involved in administering property taxes tax assessor property appraiser and tax collectornote that in some counties one or more of these roles may be held by the same individual or office. Treasurers tax collectors are key departments in the broader clarke county government.

New businesses should contact the clark county assessor at the same time the business license is acquired or prior to opening the business. Clarke county assessors office services. Clarke county has one of the highest median property taxes in the united states and is ranked 446th of the 3143 counties in order of median property taxes.

Therefore berryville residents pay taxes to both the town of berryville and the county of clarke. The median property tax in clarke county virginia is 1996 per year for a home worth the median value of 366900. The median property tax also known as real estate tax in clarke county is 199600 per year based on a median home value of 36690000 and a median effective property tax rate of 054 of property value.

Local state and us. Due dates town real estate taxes are due on june 5 and december 5 of each year. Clarke county has a history as rich as the soil along the banks of the tombigbee and alabama rivers which form its boundaries.

Clarke county assessors office services. The clarke county tax assessor is the local official who is responsible for assessing the taxable value of all properties within clarke county and may establish the amount of tax due on that property based on the fair market value appraisal. Fire ems emergency management.

Residents of towns in virginia must pay real estate and personal property taxes to both the town and the county in which the town is located.

Clarke County Virginia Personal Property Tax Lists Volume 1

Clarke County Virginia Personal Property Tax Lists Volume 1

Clarke County Virginia Personal Property Tax Lists Volume 1

Clarke County Virginia Personal Property Tax Lists Volume 1

Contact My Supervisor Clarke County Va

Genealogy Researching In African American Genealogy In Virginia

Genealogy Researching In African American Genealogy In Virginia

Http Www Vaco Org Wp Content Uploads 2019 06 County Administrator Recruitment Clarke County Pdf

Virginia Property Tax Calculator Smartasset

Virginia Property Tax Calculator Smartasset

Http Loudoun Granicus Com Metaviewer Php View Id 74 Clip Id 5359 Meta Id 137976

Clarke County Virginia Detailed Profile Houses Real Estate

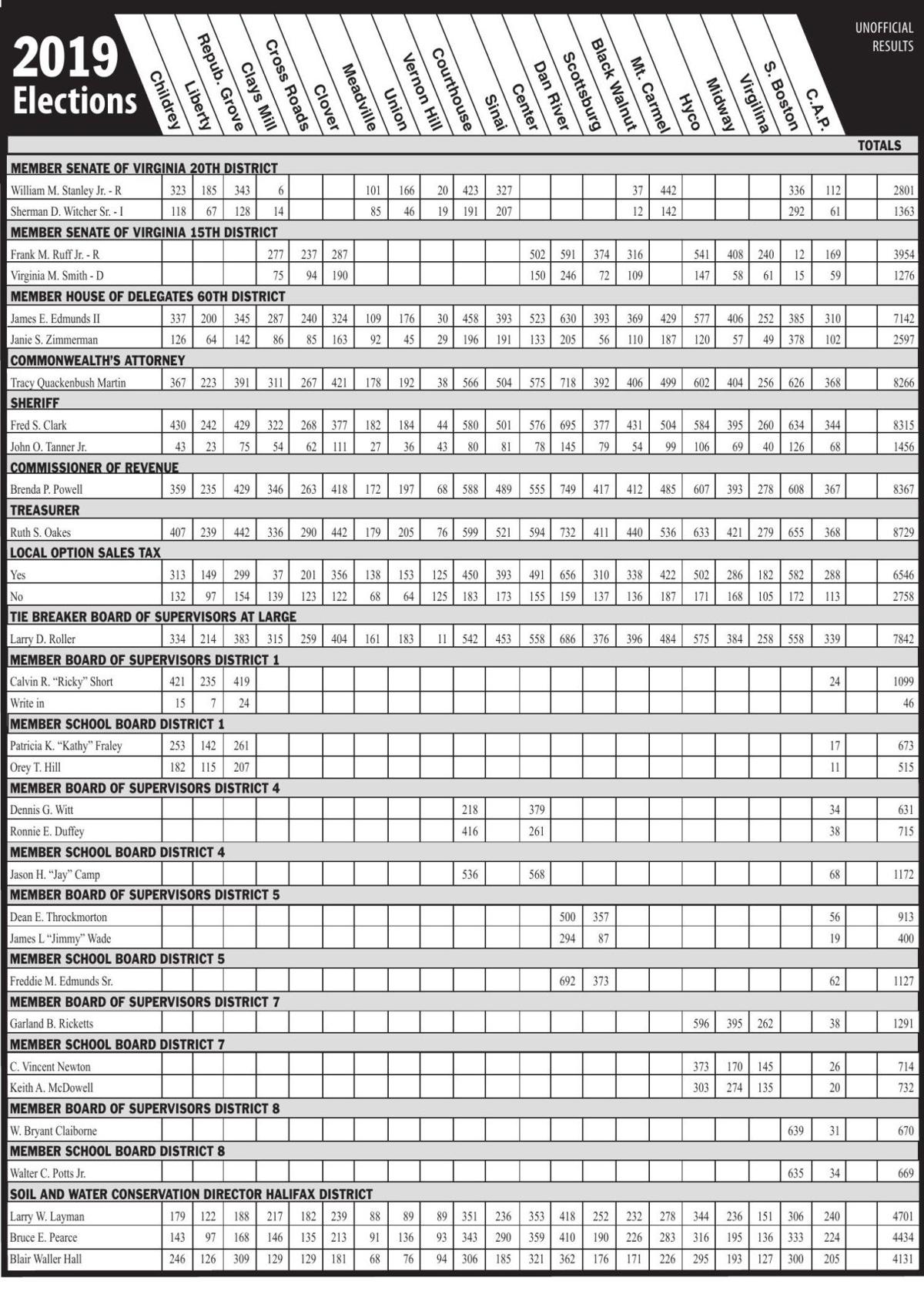

Voters Say Yes To Sales Tax Increase In Halifax County Local

Voters Say Yes To Sales Tax Increase In Halifax County Local