Please be certain this tax statement covers your property. The united states postal service postmark determines the timeliness of payment.

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

johnson county kansas personal property tax receipt

johnson county kansas personal property tax receipt is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in johnson county kansas personal property tax receipt content depends on the source site. We hope you do not use it for commercial purposes.

Johnson county is not responsible if taxes are paid on the wrong property.

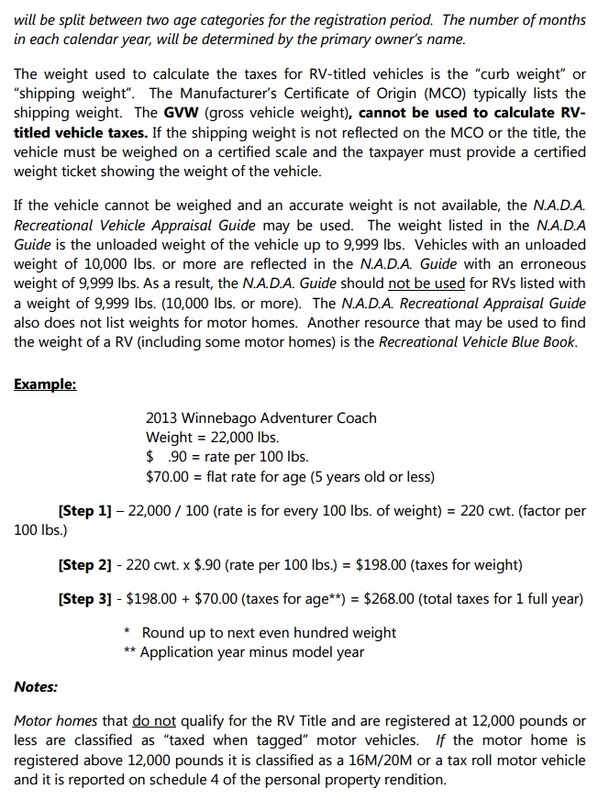

Johnson county kansas personal property tax receipt. Kansas open records act. Where is my refund. Assessing personal property tax personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than december 31 each year.

Welcome to the johnson county collectors website. Full year tax is owed on all personal property owned as of jan. See all topics here.

Make a tax payment. Kansas department of revenue. Protest forms may be filed if a meeting has not been held regarding the valuation of the property for the same tax year.

File your state taxes online. Home treasury and financial management real estate and personal property tax view and pay tax bill. Payment plan requests for individuals.

Taxes are a necessary part of every community in order to have public facilities roads bridges and protection fire health ambulance. Johnson county makes every effort to produce and publish the most current and accurate information possible. Current k 40 tax form.

Except trucks over 16000 lbs. Name and address change. Kansas law makes no provision for pro ration.

Complete and submit the payment under protest form via online by mail or in person with the county treasurers office after november 1st and on or before december 20th with. View pay tax bill. And types of watercraft.

The county collector is responsible for the collection of current and delinquent property taxes for the county and various political subdivisions within the county.

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas

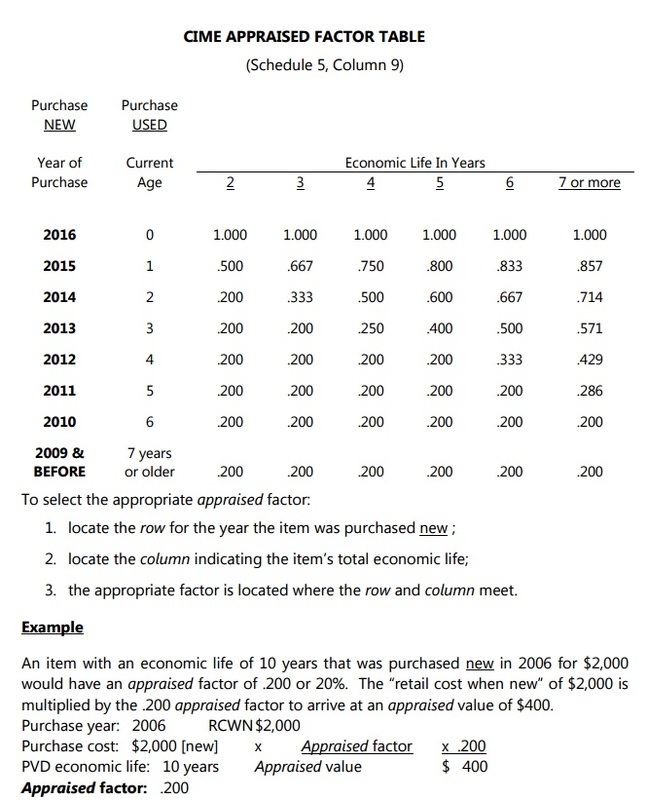

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

Request For Bids 11 296 Ohec Medical Equipment And

Request For Bids 11 296 Ohec Medical Equipment And

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

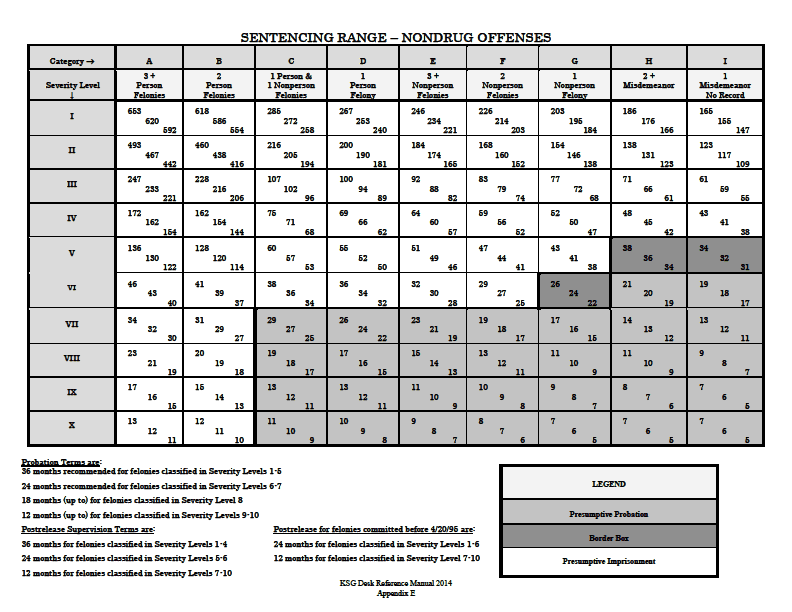

Sentencing Range For Felonies Olathe Defense Lawyers

Sentencing Range For Felonies Olathe Defense Lawyers

Johnson County Missouri Detailed Profile Houses Real Estate

Johnson County Missouri Detailed Profile Houses Real Estate

Https Www Bidnet Com Bneattachments 565559899 Pdf