The office of the jefferson county pva is responsible for assessing tangible personal property. All individuals and business entities who own or lease taxable tangible property located within kentucky on january 1 must file a tangible property tax return known as revenue form 62a500 by may 15th of that year.

jefferson county kentucky property tax rate

jefferson county kentucky property tax rate is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in jefferson county kentucky property tax rate content depends on the source site. We hope you do not use it for commercial purposes.

Thats because no county in the state has a higher average effective property tax rate than campbell at 118.

Jefferson county kentucky property tax rate. The average effective tax rate for the county is 096. Jefferson county pva news. To determine your current deliquent property tax please use the jefferson county clerks taxmaster site.

Steps to get an assessment. This entry was posted in. Please visit the jefferson county sheriffs site to view and pay your 2019 tax bill beginning november 1 2019 through april 15 2020.

We collect approximately 790 million dollars per year from over 300 thousand tax payers for 20 different taxing jurisdictions. Property taxes in jefferson county are slightly higher than kentuckys state average effective rate of 086. Welcome to the sheriffs office property tax search page.

Kentucky is ranked 1004th of the 3143 counties in the united states in order of the median amount of property taxes collected. You can now look up the amount of tax due on your real estate property or your business tangible property then have the option to pay it online. Property taxes are collected on a county level and each county in kentucky has its own method of assessing and collecting taxes.

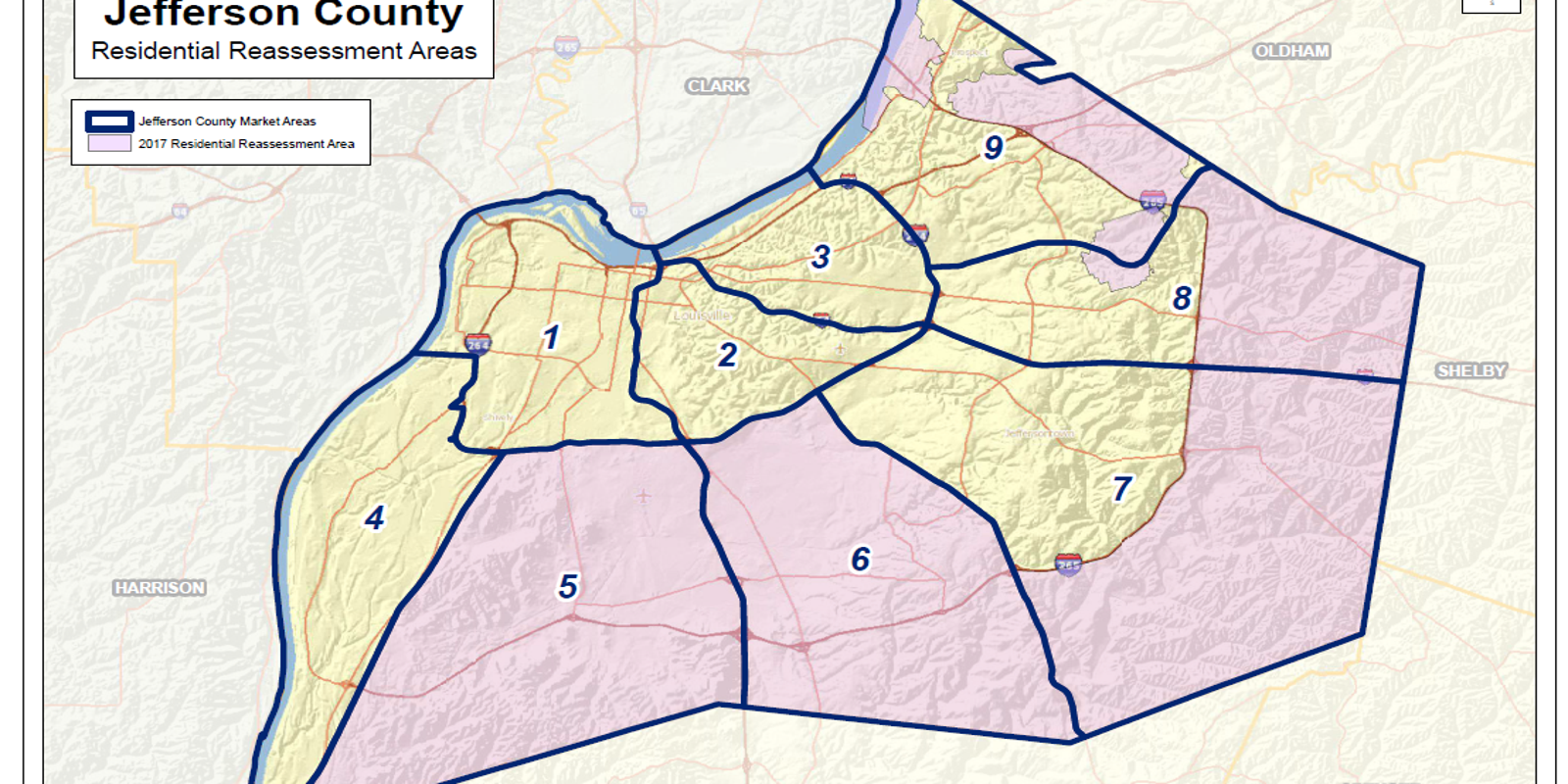

As a result its not possible to provide a single property tax rate that applies uniformly to all properties in kentucky. Properties in jefferson county are subject to an average effective property tax rate of 093. Overview of jefferson county ky taxes.

To review your homes assessment please visit the jefferson county pva site. If youre looking for a bargain on property taxes in kentucky campbell county may not be your best bet. The jefferson county sheriffs office is the primary property tax collector for state metro louisville district school fire and other special district taxes.

More than 760000 residents call jefferson county kentucky home. Jefferson county collects on average 09 of a propertys assessed fair market value as property tax. The median property tax in jefferson county kentucky is 1318 per year for a home worth the median value of 145900.

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Alabama Property Tax Calculator Smartasset

Alabama Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jcps Board Votes To Increase Property Tax Rates For 2019 20 In

Jcps Board Votes To Increase Property Tax Rates For 2019 20 In

Jcps Board Of Education Approves Property Tax Increase

Jcps Board Of Education Approves Property Tax Increase

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jcps Task Force Explores Raising Property Tax Rates News Wdrb Com

Jcps Task Force Explores Raising Property Tax Rates News Wdrb Com

Jcps Board Raises Property Tax Rate For The First Time In Five Years

Jcps Board Raises Property Tax Rate For The First Time In Five Years

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Barren County Kentucky Property Taxes 2020