Last updated on may 9 2014 by editorial staff. In the case of self occupied property the annual value is taken to be nil.

Income From House Property How To Calculate Income From House

Income From House Property How To Calculate Income From House

gross annual value of house property

gross annual value of house property is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in gross annual value of house property content depends on the source site. We hope you do not use it for commercial purposes.

The gross annual value of the property will be actual rent received or receivable.

Gross annual value of house property. Municipal authorities normally charge house taxmunicipal taxes on the basis of annual letting value of such house property. Praveen unnikrishnan july 30 2012 1 comment. In order to calculate any income from house property you need to know the annual value of house property.

B municipal value this is the value as determined by the municipal authorities for levying municipal taxes on house property. How to calculate income from house property for income tax purposes. The av of buildings is the estimated gross annual rent of the property if it were to be rented out excluding furniture furnishings and maintenance feesit is determined based on estimated market rentals of similar or comparable properties and not on the actual rental income received.

How to calculate gross net annual value of house property. Calculating gross annual value gav income tax. Annual value is the amount for which the property might be let out on a yearly basis.

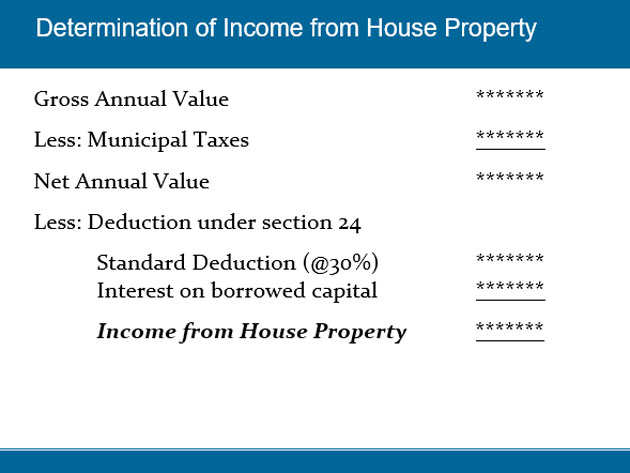

If you are having more than 1 house then income tax department ask you to calculate the annual value of your house so that they can determine tax liability on it. From such net annual value deductions as permissible us 24a b are allowed and the balance is the income under the head income from house property. Gross annual value gav also called the annual value is the income that can be earned from a property irrespective of whether it is let out or not on a yearly basis.

C fair rent fair rent is the rent which a similar property can fetch in the same or similar locality if it is let out for a year. The value arrived at after deducting the municipal taxes if any may be referred to as the net annual value annual value as per income tax act. If a property is self occupied then the gav is considered to be nil.

You can also say that it is the estimated rent that you could get if the property was rented out. For the purpose of calculating the taxable amount of house rent we have to first derive the gross annual value of the property. You must be having a home or might be 2 or more.

Gross annual value of your house property income chargeable under the head income from house property. In the case of property that is rented out the gross annual value is the municipal value the de facto rent whether. House property which was let out for part of the year and rest of the year occupied for own residence.

In falkirk in scotland the gross annual value is used to calculate council house rent based on factors such as house type age structure number of apartments overall floor area location and type of heating.

Gross Annual Value For Let Out Property House Property Let It

Gross Annual Value For Let Out Property House Property Let It

Analysis Of Income From House Property Taxguru

Analysis Of Income From House Property Taxguru

Session 7 Income From House Property By B Pani M Com Llb Fca

Session 7 Income From House Property By B Pani M Com Llb Fca

Step 2 Calculate Gav How To Compute

Step 2 Calculate Gav How To Compute

How To Calculate Income From House Property Section 24 80c And

How To Calculate Income From House Property Section 24 80c And

Gav Gross Annual Value Of House Property Income Tax Act

Gav Gross Annual Value Of House Property Income Tax Act

House Property Income Taxes Calculate House Property Income

House Property Income Taxes Calculate House Property Income

Iras Understanding Your Industrial Property Annual Value

Iras Understanding Your Industrial Property Annual Value

Income Form House Property Ay 2018 19 Annual Value Of Let Out

Income Form House Property Ay 2018 19 Annual Value Of Let Out

01 01 2018 02 01 2018 Accounting Taxation

01 01 2018 02 01 2018 Accounting Taxation