A personal property tax is a levy imposed on a persons property. Personal property tax tangible personal property personal property everything that is the subject of ownership that does not come under the denomination of real property.

Real Property And Personal Property Definition And Differences

Real Property And Personal Property Definition And Differences

definition of personal property for tax purposes

definition of personal property for tax purposes is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in definition of personal property for tax purposes content depends on the source site. We hope you do not use it for commercial purposes.

Any right or interest that an individual has in movable things.

Definition of personal property for tax purposes. Youve always dreamed of buying a home condo or other structure. In most cases however the cost of the item of personal property must be spread out over the useful life of the item. In most states a business that owned tangible property on january 1 must file a tax return form with the property appraisal office no.

Related to personal property. Youre considered to use a dwelling unit as a residence if you use it for personal purposes during the tax year for more than the greater of. This limits revenue growth from personal property taxes through deliberate increases in tax rates.

An example of a personal property tax are the taxes levied in arlington county virginia on all motor vehicles that are normally housed overnight in that county. Rental property personal use. Tangible personal property is subject to ad valorem taxes.

A personal property tax is imposed by state or local tax authorities based on the value of an individuals personal property such as a tax thats imposed on the value of a car and assessed as part of the annual vehicle registration fee. You basically want a place you can truly call your own but before you set out to buy your dream home youll want to know more about the different types of property for tax purposes. However the lack of a distinct definition of a fixture and the grey area surrounding the delineation of real vs.

The purchase of personal property is a deductible business expense. Its also called an ad valorem tax. Personal property suggests the taxpayer become knowledgeable of relevant local case law and historical assessment practices or seek advice from an experienced tax advisor andor valuation professional to assess their property tax position.

Personal property tax regimes may be subject to rate limits which constrains the ability of state and local governments from raising tax rates above an absolute threshold or above a fixed growth rate. The tax is levied by the jurisdiction where the property is located and it includes tangible property that is not real propertytangible property includes movable man made objects that have a physical form and can be seen and touched. Personal property tax examples.

In some cases the purchase price can be listed as a business expense in the first year of purchase. If you rent a dwelling unit to others that you also use as a residence limitations may apply to the rental expenses you can deduct.

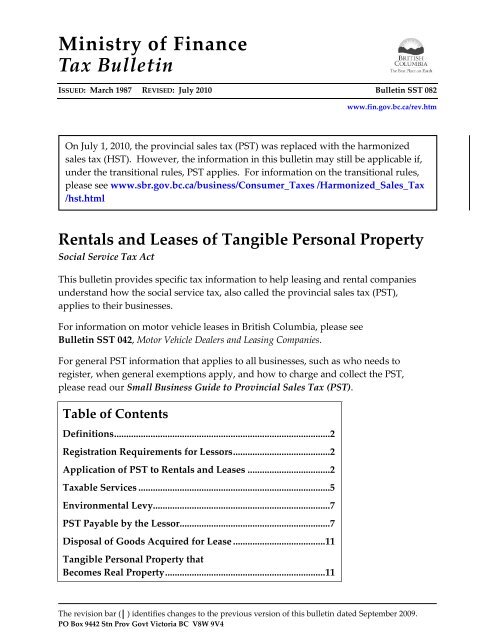

Bulletin Sst 082 Rentals And Leases Of Tangible Personal Property

Bulletin Sst 082 Rentals And Leases Of Tangible Personal Property

Tangible Personal Property State Tangible Personal Property Taxes

Tangible Personal Property State Tangible Personal Property Taxes

The Tax Abatement Process Ppt Download

The Tax Abatement Process Ppt Download

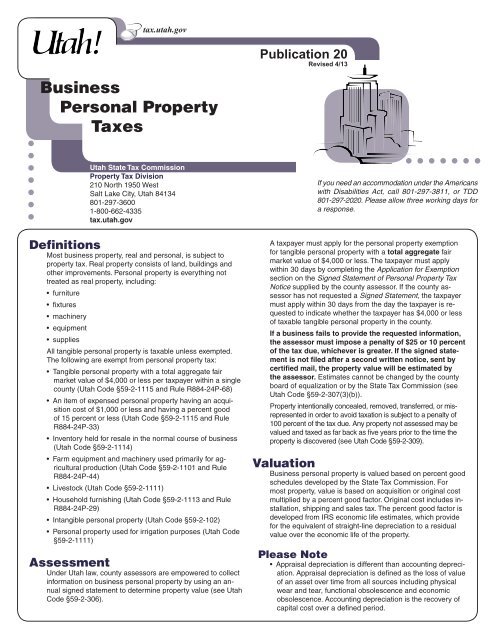

Pub 20 Utah Business Personal Property Taxes Utah State Tax

Pub 20 Utah Business Personal Property Taxes Utah State Tax

Personal Property Tax Definition Valuation Poconnor Com

Personal Property Tax Definition Valuation Poconnor Com

What Is Business Personal Property Tax Poconnor Com

What Is Business Personal Property Tax Poconnor Com

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

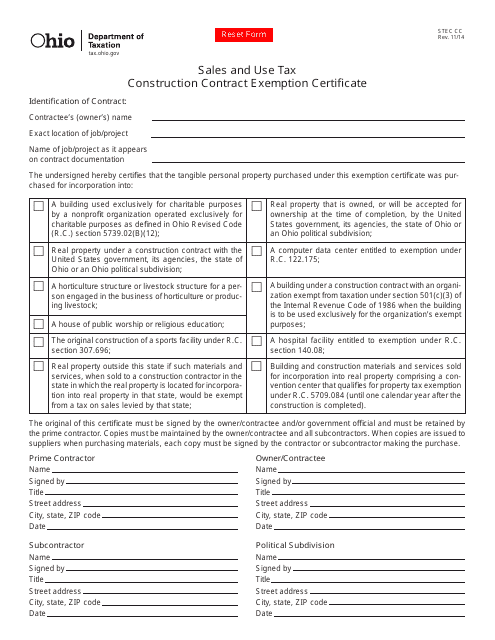

Form Stec Cc Download Fillable Pdf Or Fill Online Sales And Use

Form Stec Cc Download Fillable Pdf Or Fill Online Sales And Use

Personal Property Tax Definition Valuation Poconnor Com

Personal Property Tax Definition Valuation Poconnor Com

Property Tax Season Shift Indy

Property Tax Season Shift Indy

Personal Property Basics Level I Tutorials Ppt Download

Personal Property Basics Level I Tutorials Ppt Download