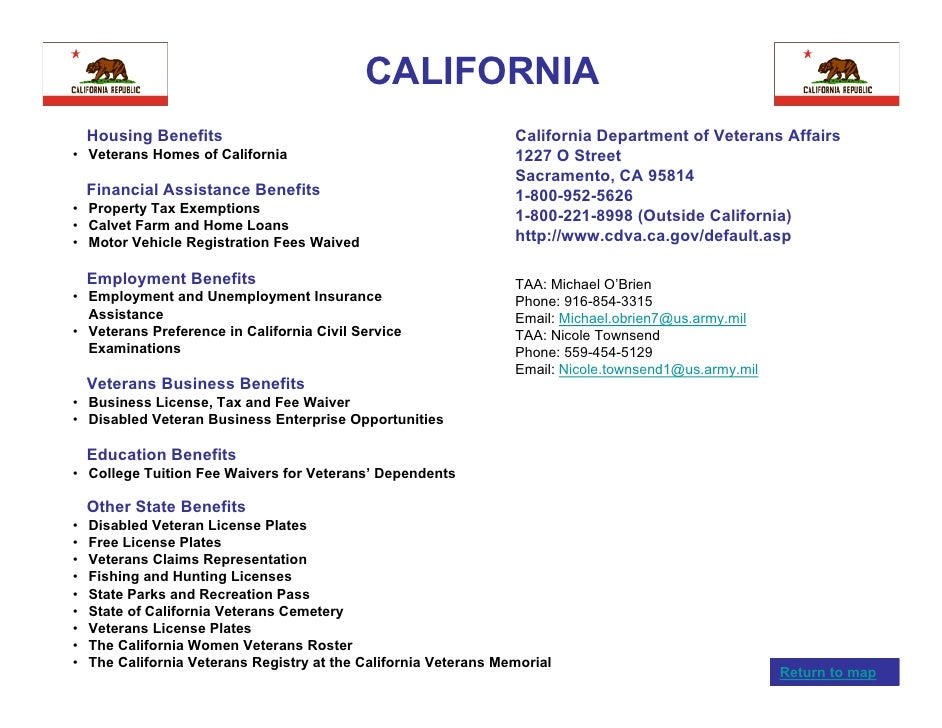

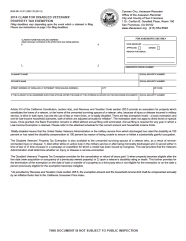

California property tax exemptions. The veterans exemption provides exemption of property not to exceed 4000 for qualified veterans who own limited property see revenue and taxation code section 205the veterans exemption may be claimed by a person currently serving in the military service or one who has been honorably discharged the unmarried surviving spouse or either parent of a deceased veteran.

California Important Real Property Tax Dates

california property tax exemption for disabled

california property tax exemption for disabled is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in california property tax exemption for disabled content depends on the source site. We hope you do not use it for commercial purposes.

If youre a senior citizen homeowner in california youre in luck the state offers a variety of property tax exemptions for individuals 55 or older.

California property tax exemption for disabled. The exemption reduces the annual property tax bill for a qualified homeowner by up to 70. California for instance allows qualified disabled veterans to receive a property tax exemption on the first 196262 of their primary residence if their total household income does not exceed 40000 and the veteran is 100 percent disabled as a result of service. One for veterans and one for disabled veterans.

What is the homeowners exemption. Any taxpayer can request an immediate reappraisal if his home has been. California has two separate property tax exemptions.

The disabled veterans exemption reduces the property tax liability on the principal place of residence of qualified veterans who due to a service connected injury or disease have been rated 100 disabled or are being compensated at the 100 rate due to unemployability. The state provides generous property tax relief programs to senior citizens and disabled veterans. These veterans must have been rated 100 disabled or are being compensated at the 100 rate due to unemployment due to a service connected injury or disease.

California also offers various forms of property tax assistance to certain homeowners. The california constitution provides for the exemption of 7000 maximum in assessed value from the property tax assessment of any property owned and occupied as the owners principal place of residence. The disabled veterans exemption reduces property tax liability for qualified veterans.

California property tax relief information. California has some of the highest priced real estate in the country with property tax bills to match. The california constitution provides a 4000 real property eg a home or personal property eg a boat exemption for honorably discharged veterans or the spouse or pensioned parent of a deceased honorably discharged veteran.

The chief programs in california which are implemented by county assessors offices based on ones individual situation are summarized here. The first 7000 of the full value of your home is exempt from property tax. Disabled veterans in arkansas may qualify for a full property tax exemption on hisher primary residence if the veteran is rated as blind in one or both eyes or has lost the use of one or more limbs or is 100 percent permanently and totally disabled as a result of military service.

Sb 562 Disabled Veterans Property Tax Exemptions Ngac

Sb 562 Disabled Veterans Property Tax Exemptions Ngac

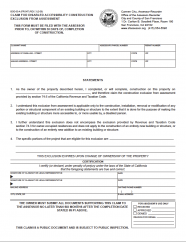

Claim For Disabled Accessibility Construction Exclusion From

Claim For Disabled Accessibility Construction Exclusion From

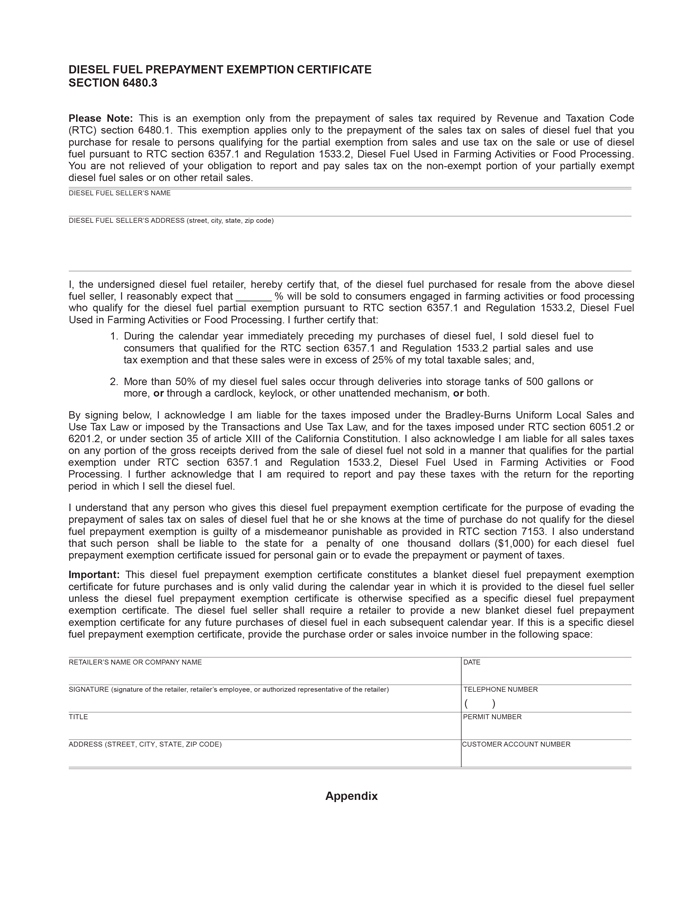

Sales And Use Tax Regulations Article 7

Sales And Use Tax Regulations Article 7

Claim For Disabled Veterans Property Tax Exemption Ccsf Office

Claim For Disabled Veterans Property Tax Exemption Ccsf Office

Property Tax Postponement Program For California Homeowners

Property Tax Postponement Program For California Homeowners

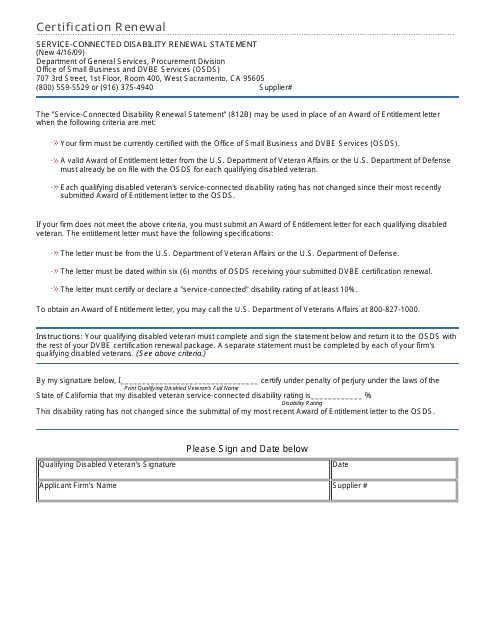

California Service Connected Disability Renewal Statement Form

California Service Connected Disability Renewal Statement Form

Championed Making California Affordable Ca Senate Republican Caucus

Championed Making California Affordable Ca Senate Republican Caucus