How much property damage auto insurance do i need. Property damage coverage is one of two types of liability auto insurance.

How Much Car Insurance Coverage Do I Really Need

How Much Car Insurance Coverage Do I Really Need

auto insurance property damage how much

auto insurance property damage how much is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in auto insurance property damage how much content depends on the source site. We hope you do not use it for commercial purposes.

It helps pay to repair damage you cause to another persons vehicle or property.

Auto insurance property damage how much. Laws vary from state to state regarding how much and what types of car insurance you need to carry. Types of property that are covered by property damage liability insurance include the other persons car houses stores trees fences telephone poles and more. Not only that but just 39 percent of people with liability insurance had a property damage liability claim that year according to iso.

In 2016 the average auto insurance claim for property damage was 3683. And that might be plenty. Its a good idea to have at least 500000 worth of coverage that encompasses both types of liability coverageproperty damage liability and bodily injury liability.

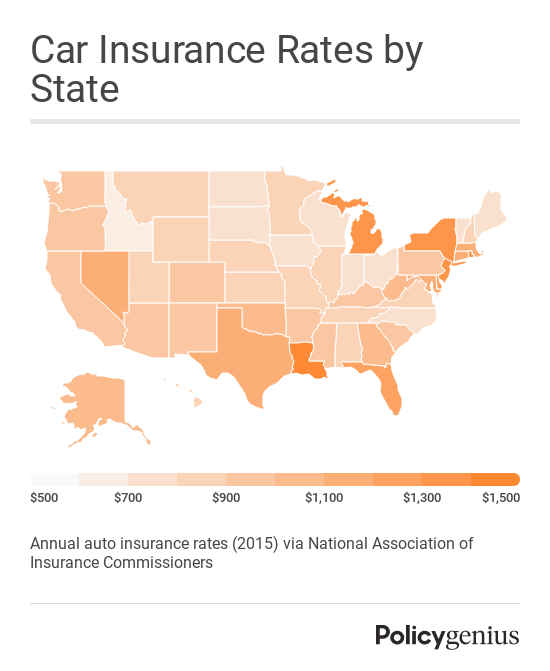

Property damage liability coverage. Auto insurance deductibles typically apply per claim. Auto insurance policies vary widely depending on your car your driving record and your credit so its wise to do some research.

How to shop for car insurance. Property damage liability coverage is required by law in most states. So how much car insurance do you really need to protect you your passengers.

Is part of a car insurance policy. Property damage liability insurance covers the cost of damages to someone elses property after an accident you cause. Once youve decided how much car insurance you need its time to begin shopping.

Most commonly your property damage will pay out when you are at fault for an accident that causes damage to someone elses car. Most states require vehicle owners to carry at least liability insurance which pays for minor injuries and damage in the event of a collision. To repair that damage you will need the physical damage coverage of your collision and comprehensive policies.

Property damage liability insurance coverage. This insurance covers the cost of damages caused to others whether you damaged their car house or any other type of personal property. Property damage liability insurance is one of the major coverage types that drivers are required to have by law.

Knowing this you might decide the state minimum for property damage liability is plenty for you. Considering that the average cost of a car today in the us in the high 30000s and there are many vehicles over that in the 40000s 50000s and higher i would recommend no less than 500. Property damage liability insurance does not cover damage to your own car.

Auto property damage liability insurance helps pay for damage to someone elses car or other property due to an accident you caused.

Auto Car Insurance Downey Ca Los Angeles Ca The Point

Auto Car Insurance Downey Ca Los Angeles Ca The Point

How Much Auto Insurance Do You Need Johnson Jensen

What Is Property Damage Liability Coverage Insurify

What Is Property Damage Liability Coverage Insurify

How Much Property Damage Liability Should I Have Roberti S

How Much Property Damage Liability Should I Have Roberti S

How Much And What Kind Of Car Insurance You Need Teresa S

How Much And What Kind Of Car Insurance You Need Teresa S

Auto Insurance How Much Is Enough Infographic Facts

Auto Insurance How Much Is Enough Infographic Facts

Car Accident Property Damage Claims When To Lawyer Up

Car Accident Property Damage Claims When To Lawyer Up

Lvk Compensation For Traffic Accidents

Lvk Compensation For Traffic Accidents

Chapter 4 Types Of Auto Insurance Coverage Moneycounts A Penn

What Happens If You Have A Car Accident Without Insurance

What Happens If You Have A Car Accident Without Insurance