To calculate capital gains find out your basis in. Report the gain or loss on the sale of rental property on form 4797 sales of business property or on form 8949 sales and other dispositions of capital assets depending on the purpose of the rental activity.

Depreciation Recapture Calculator For Rental Property Avoid The

Depreciation Recapture Calculator For Rental Property Avoid The

irs form to report sale of investment property

irs form to report sale of investment property is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in irs form to report sale of investment property content depends on the source site. We hope you do not use it for commercial purposes.

Where this information is reported depends on the use of the property main home timesharevacation home investment property business use or rental use.

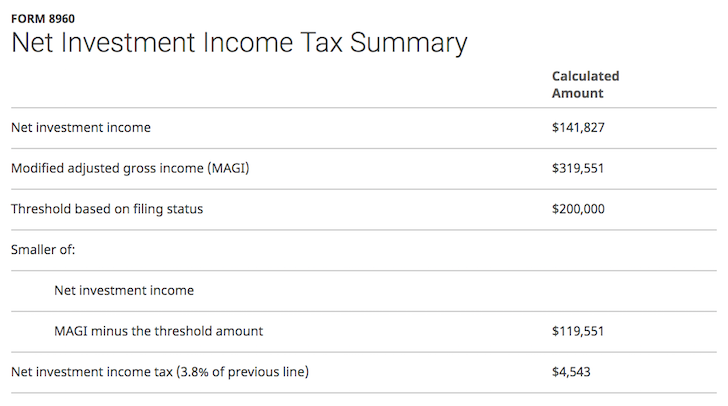

Irs form to report sale of investment property. How to report the sale of inherited property on a tax return. Gains from the sale of real estate property are capital gains and are subject to gains tax rules for long and short term gains. The irs treats home sales a bit differently than most other assets generating capital.

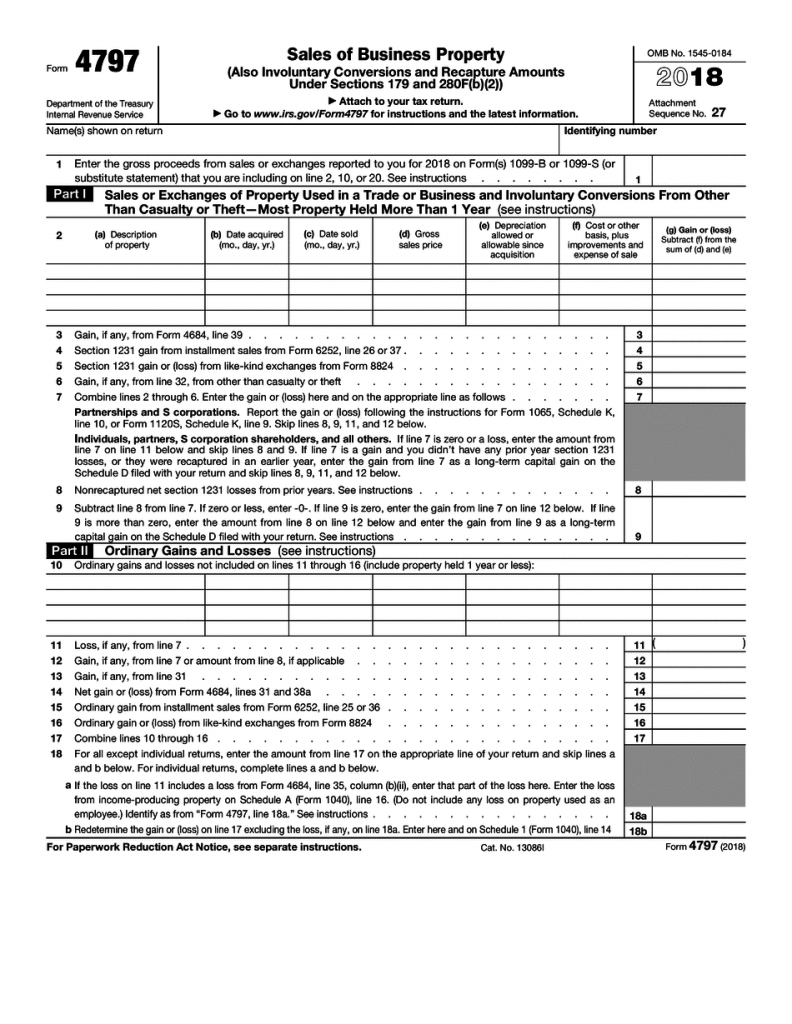

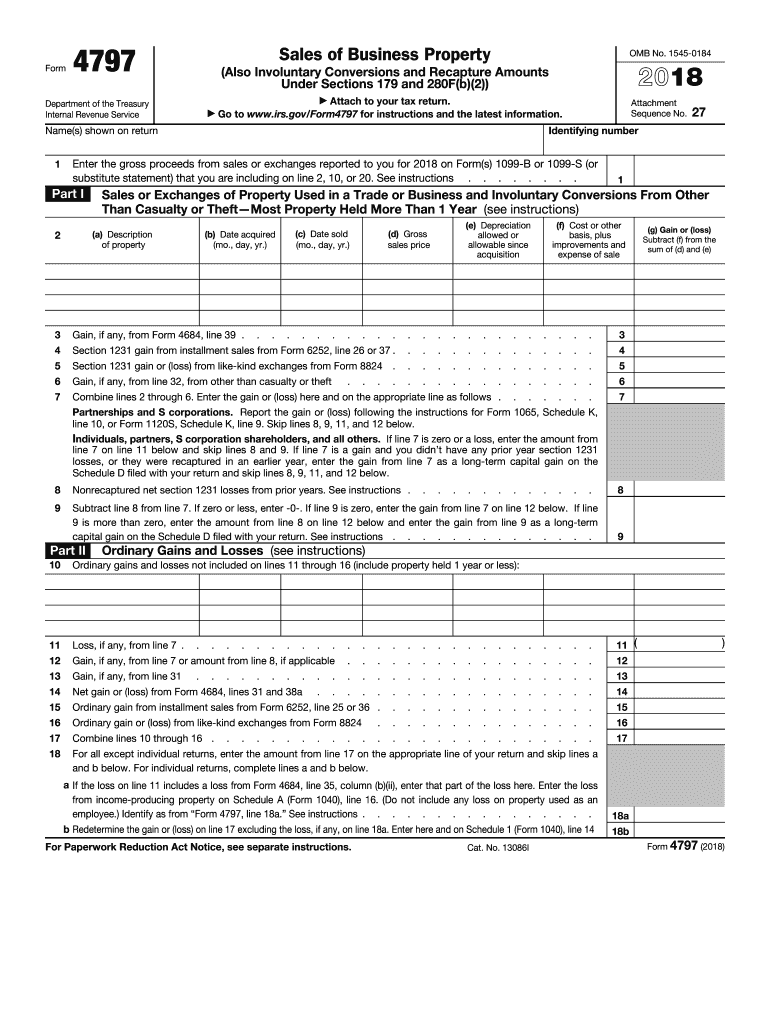

Internal revenue service tax forms and publications 1111 constitution ave. If you sell real estate you have to report the gain or loss on the sale to the irs. It depends but you will need to report the sale of this investment property as the sale of a capital asset.

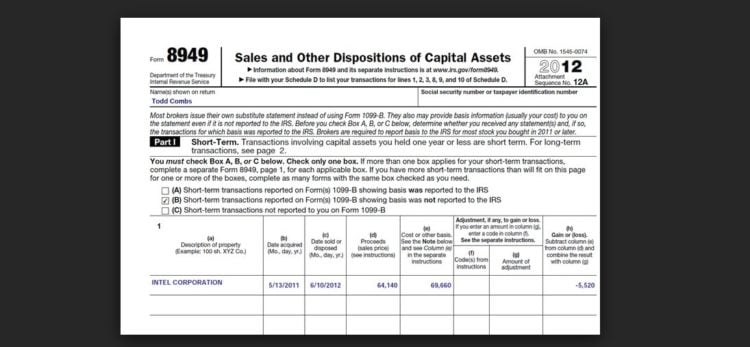

Individuals typically use schedule d form 1040 or 1040 sr capital gains and losses together with form 4797 or form 8949. If you inherit a home land or other real estate and sell it you may have to pay taxes on any gain you made on the property. If you sell a vacant lot you bought as an investment you report the result of the sale as a capital gain or loss rather than regular income.

You must report that part of the sales price as interest income for the year of sale. According to internal revenue service publication 544 sales and other dispositions of assets you must report the sale of vacant land as a. Part of the sales price represents interest accrued to the date of sale.

You must report the gain on form 8949 and also on schedule d of your form 1040. Real estate is what the irs calls a capital asset. When you sell investment property all of your profits are subject to either capital gains tax or.

If you bought the land for personal use you report any gains from the sale but not any losses. To enter this as a capital asset sale in turbotax log into your tax return for turbotax online sign in click here and type investment income gains and losses in the search bar then select jump to investment income gains and losses. Form 1099 s proceeds from real estate transactions is used to report proceeds from real estate transactions.

You report all capital gains on the sale of real estate on schedule d of irs form 1040 the annual tax return. How to file the sale of vacant land with the irs. How to calculate capital gains sale of investment property on which mortgage is owed.

Opportunity Zones Tax Reporting How To Insights By Cadre

Opportunity Zones Tax Reporting How To Insights By Cadre

5 Cryptocurrency Tax Questions To Ask On April 15th Cointelegraph

Form 8949 Instructions Information On Capital Gains Losses Form

Form 8949 Instructions Information On Capital Gains Losses Form

How To Report The Sale Of Inherited Property On A Tax Return

How To Report The Sale Of Inherited Property On A Tax Return

Tax Form 8949 Instructions For Reporting Capital Gains And Losses

Tax Form 8949 Instructions For Reporting Capital Gains And Losses

How To Report The Sale Of Inherited Property On A Tax Return

How To Report The Sale Of Inherited Property On A Tax Return

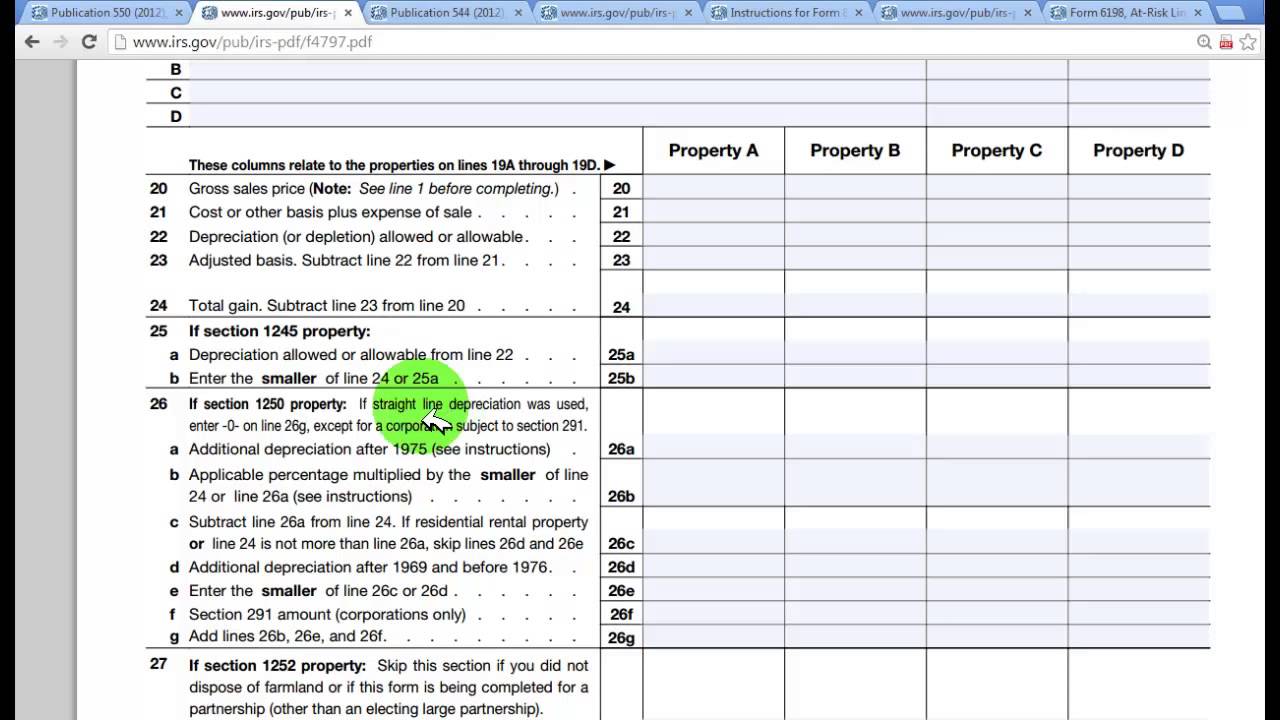

Understanding Depreciation Recapture When You Sell A Rental

Understanding Depreciation Recapture When You Sell A Rental

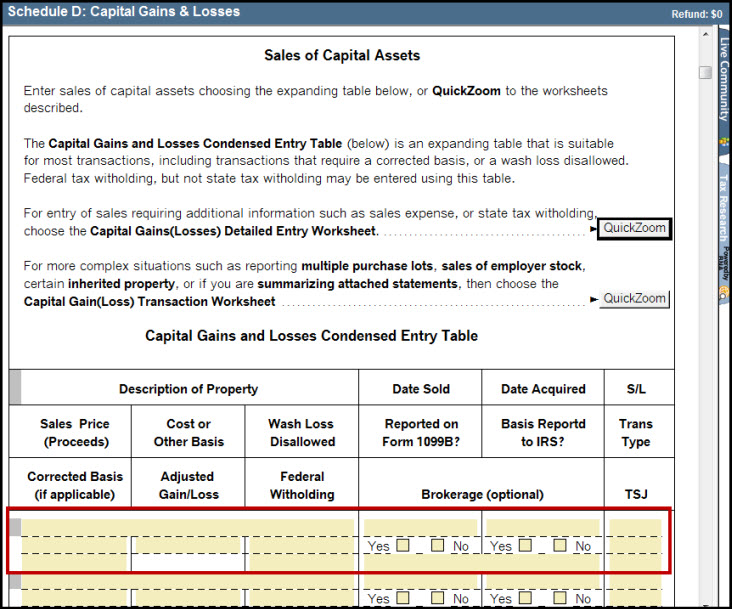

Schedule D Capital Gains And Losses Smart Workshee Tax Pro

Schedule D Capital Gains And Losses Smart Workshee Tax Pro

Tax Treatment Of Sale Of Rental Property Youtube

Tax Treatment Of Sale Of Rental Property Youtube

/8949-SalesandOtherDispositionsofCapitalAssets-1-44c0f523131349f6a207a148fb495962.png)

/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)