You can contact your lender to find out when they typically make these payments. Go to your city or county tax assessors website and look for a link to property search or property tax records.

How To Read Your Property Tax Bill

How To Read Your Property Tax Bill

how to find out what you paid in property taxes

how to find out what you paid in property taxes is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to find out what you paid in property taxes content depends on the source site. We hope you do not use it for commercial purposes.

If you pay your property taxes yourself the quickest way to find out how much you paid is simply to go back through your check registers bank account statements or credit card statements.

How to find out what you paid in property taxes. Even if the property tax is 3000 and the mortgage is 300000 a delinquency on the tax results in a lien that can later result. If you have lost track of how much income tax you have paid you can find out using a number of ways. You can find out about your tax obligations in many ways.

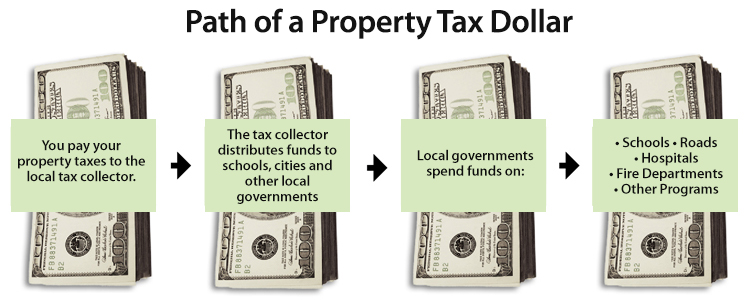

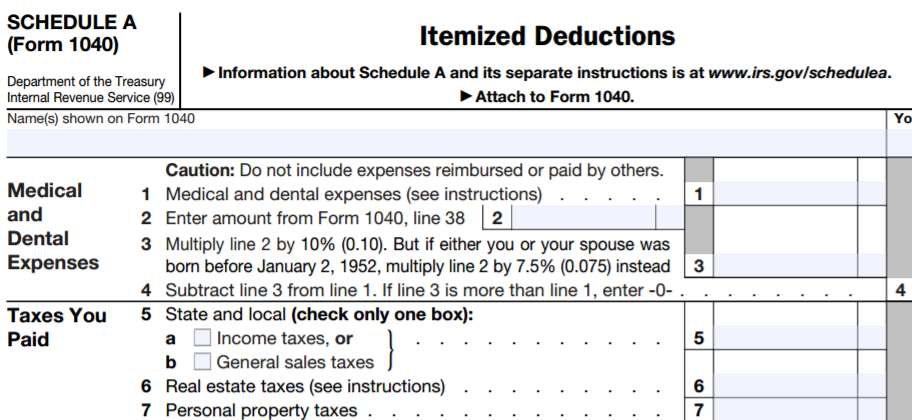

Generally employers are responsible for withholding the appropriate taxes from their employees paychecks and for paying them timely. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your personal deductions on schedule a of form 1040.

Of course its also a. In some cases the reason you want to know how to find out if property taxes have been paid is that you want to make sure the money is going where its supposed to. How to find out what you paid in real estate property taxes if you plan to deduct your property taxes on your federal income tax return you need to know what you paid.

County tax appraisal offices usually assess residential and commercial real estate annually and many appraisal offices publicly disclose tax records through official websites. Income taxes include federal state local medicare and social security taxes. Property taxes hold more rights in the property than the mortgage.

If youre unsure how much you paid in real estate taxes you can quickly obtain the information from your county assessor or through tax documents you receive from your mortgage lender. How to find out if property taxes are paid. If you pay your property tax with your mortgage you can only deduct it after your lender has paid the tax on your behalf.

If property taxes are unpaid on real estate the owner could lose his property in a tax foreclosure or tax deed which will result in the auction of the property to recover the taxes. Reference 1 according to foreclosurelistings in april 2010 629325 public tax auctions. Ultimately the responsibility for paying those taxes is on you even though your lender has every reason to make sure theyre paid on time.

How To Find Out How Much You Paid In Real Estate Property Taxes

How To Find Out How Much You Paid In Real Estate Property Taxes

How To Pay Property Tax For The Year 2016 17 Citizen Matters

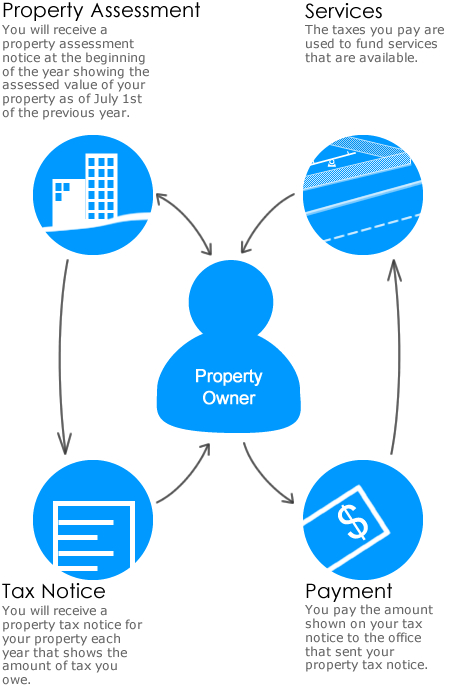

Annual Property Tax Province Of British Columbia

Annual Property Tax Province Of British Columbia

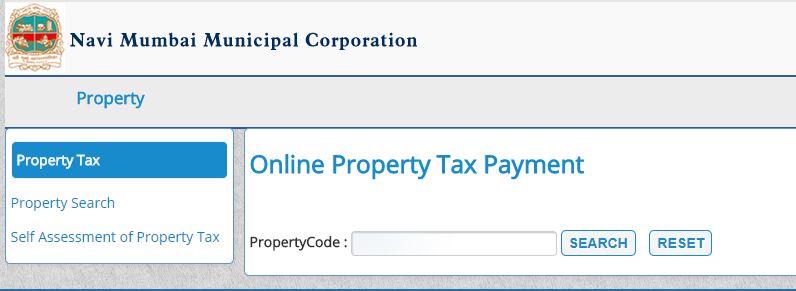

How To Pay Property Tax In Mumbai

How To Pay Property Tax In Mumbai

Step By Step Guide To Pay Property Tax In Mumbai

Step By Step Guide To Pay Property Tax In Mumbai

Property Tax System Basics Gregg Cad Official Site

Property Tax System Basics Gregg Cad Official Site

Property Taxes 101 How To Claim A Tax Deduction Rapidtax

Property Taxes 101 How To Claim A Tax Deduction Rapidtax

What Is Tax Liability Definition Examples More

What Is Tax Liability Definition Examples More

How To Pay Property Tax In Mumbai

How To Pay Property Tax In Mumbai