Only residents of new jersey pay higher property taxes than illinois with vermont texas and new hampshire not far behind. Property taxes in illinois support city governments county governments and school districts along with a vast number of other local services and projects.

Illinois Has Second Highest Property Taxes How Are They Calculated

how property taxes are calculated in illinois

how property taxes are calculated in illinois is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how property taxes are calculated in illinois content depends on the source site. We hope you do not use it for commercial purposes.

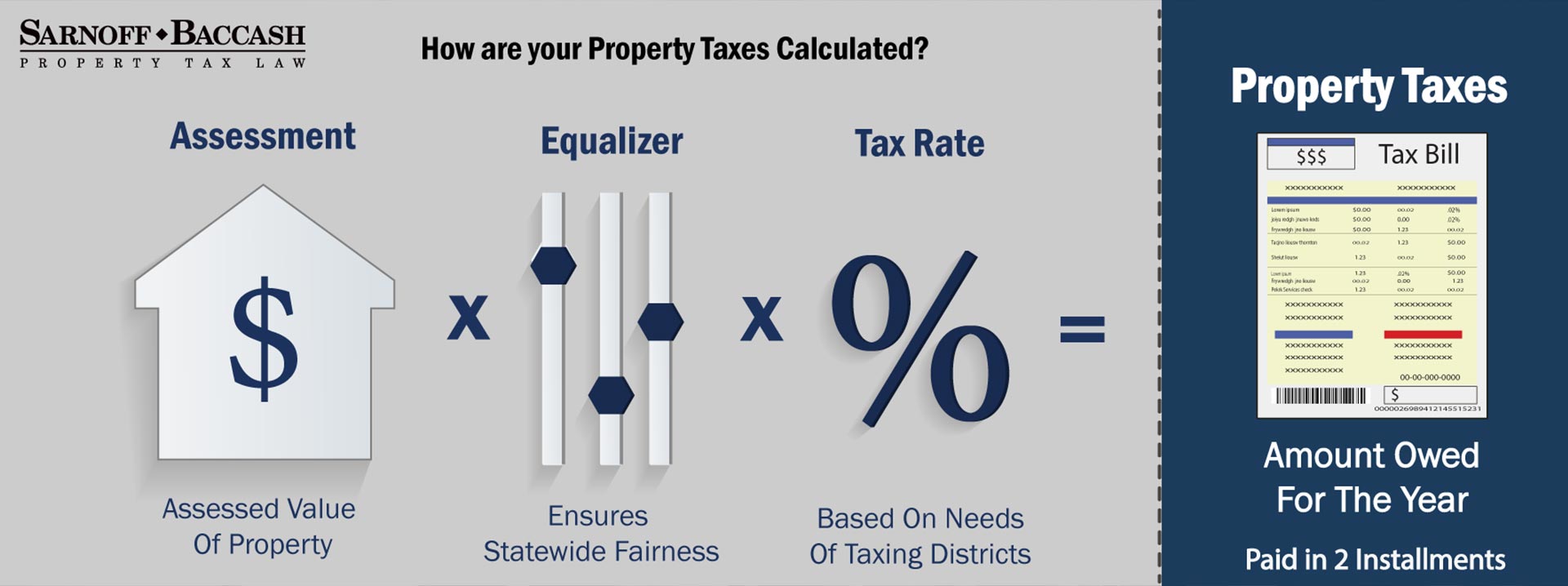

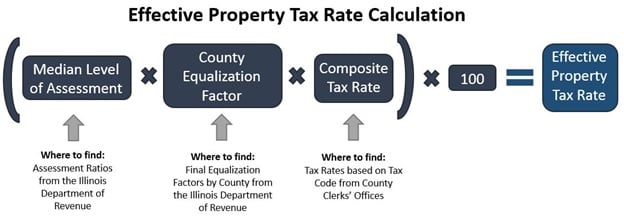

If youve noticed that your property tax bill increases at a rate that doesnt correspond with changes in home prices on the market you may wonder how your county assessor determines your annual property tax bill.

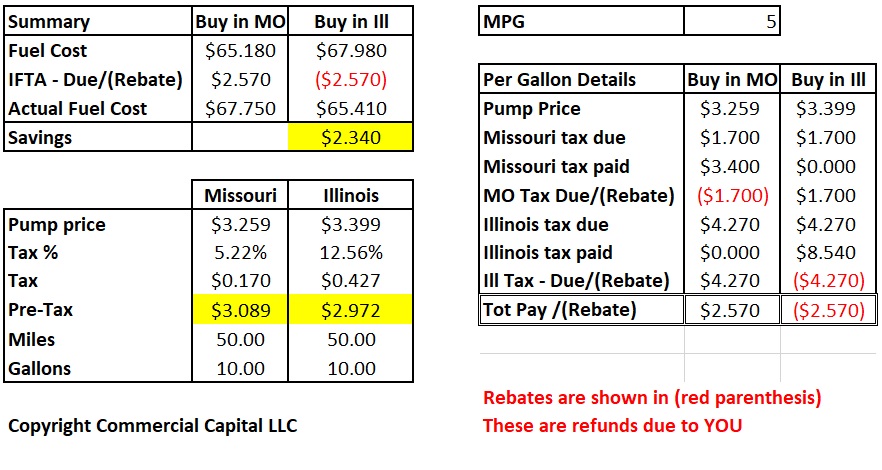

How property taxes are calculated in illinois. Most people will tell you they think their taxes are too high and now you have the confirmation. How are property taxes calculated in illinois. If you paid 1000 in property taxes in 2019 you could claim a credit of 50 on your income tax return thats 50 less that you end up paying in taxes.

How to calculate property taxes in illinois. For example the illinois property tax credit is equal to 5 of illinois property tax paid on a principal residence. Our illinois property tax calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in illinois and across the entire united states.

These taxes on a persons possessions are called personal property taxes and are usually calculated differently than the home property taxes above. Property owners in the state the report found paid an average of 1782 annually. The way taxes are actually calculated is that the.

In addition to the property tax that most people are familiar with for homes and real estate there can sometimes be other forms of property tax for other forms of property. The average annual effective property tax on a single family house in illinois is 213 percent. Our cook county property tax calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in illinois and across the entire united states.

While effective property tax rates might be on the decline in some communities census data show illinois families are seeing a larger share of their household budgets eaten up by property tax bills. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Property taxes pay for essential. Among the types of taxing districts that may appear on your property tax bill in illinois are fire protection districts sanitary districts park districts and even mosquito abatement districts. Illinois homeowners pay the second highest property taxes in the nation according to real estate data company attom data solutions.

Property Tax Resources In Chicago Il Sarnoff Baccash

Property Tax Resources In Chicago Il Sarnoff Baccash

Calculate Your Community S Effective Property Tax Rate The Civic

Calculate Your Community S Effective Property Tax Rate The Civic

Illinois Property Tax Calculator Smartasset

Illinois Property Tax Calculator Smartasset

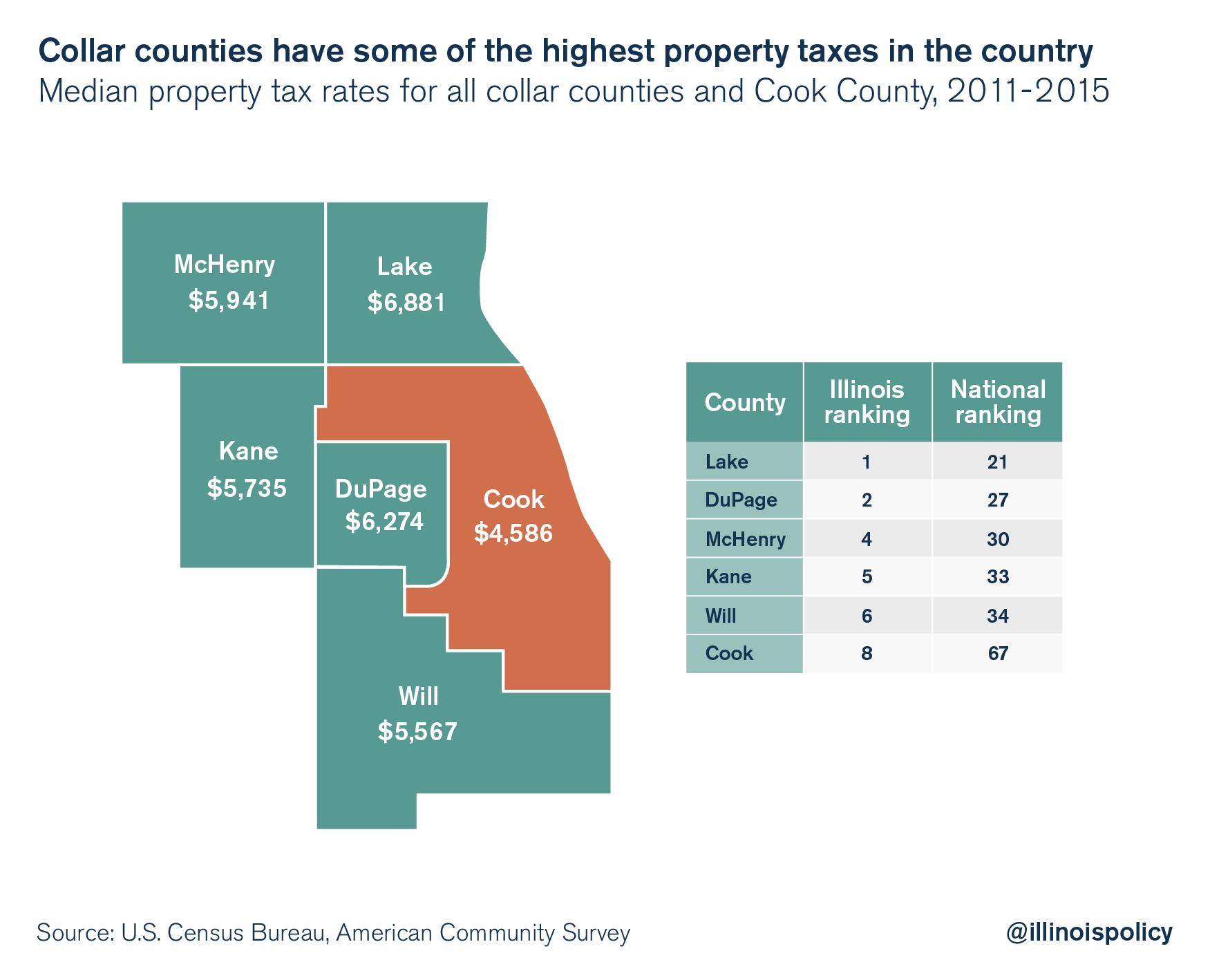

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

How Are Property Taxes Calculated In Illinois Kensington Research

How Are Property Taxes Calculated In Illinois Kensington Research

Average Property Tax Rates And Homeowners Bills In Mchenry County

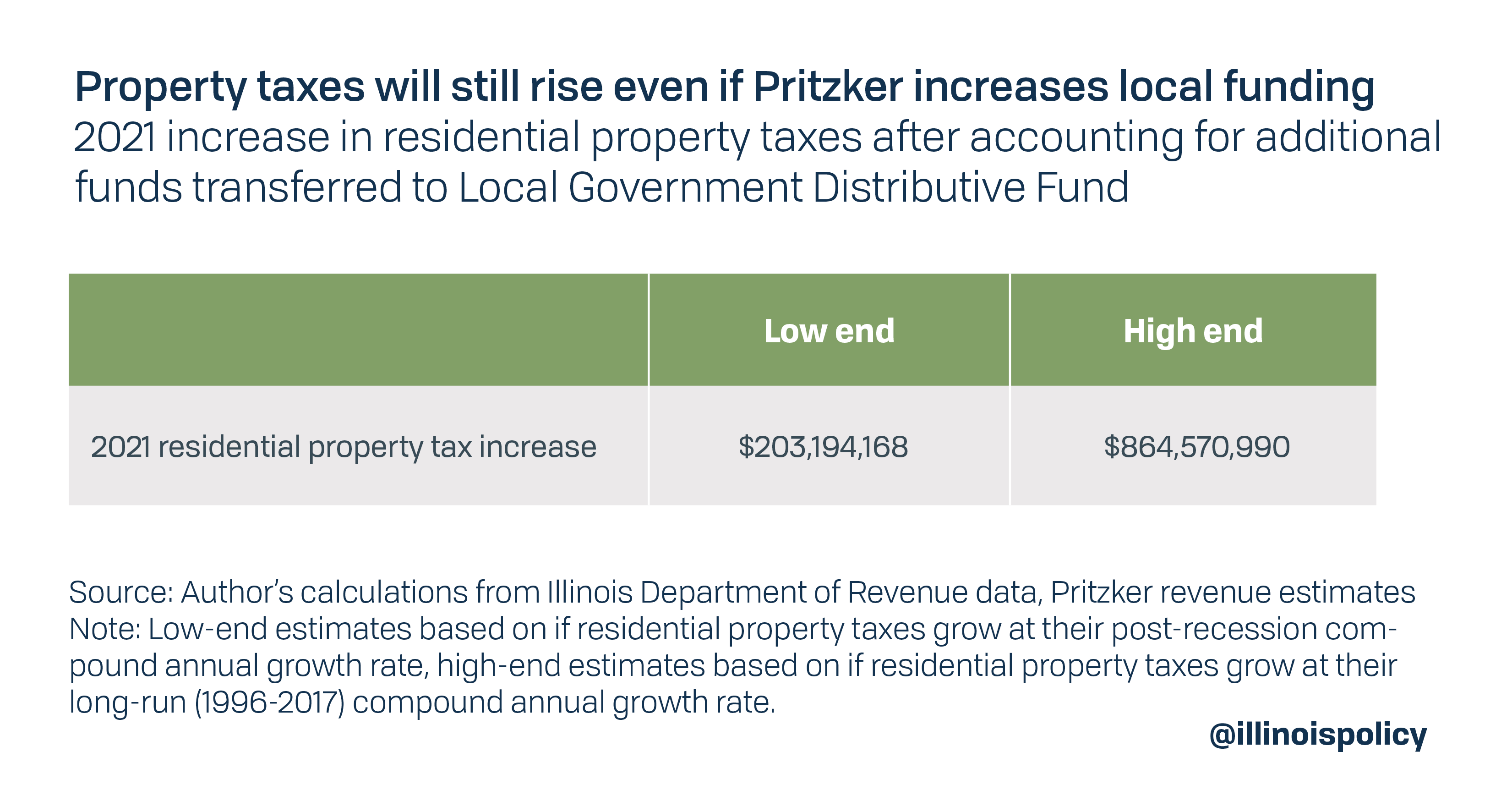

Property Tax Hikes Wipe Out Pritzker S Tax Relief Promise

Property Tax Hikes Wipe Out Pritzker S Tax Relief Promise

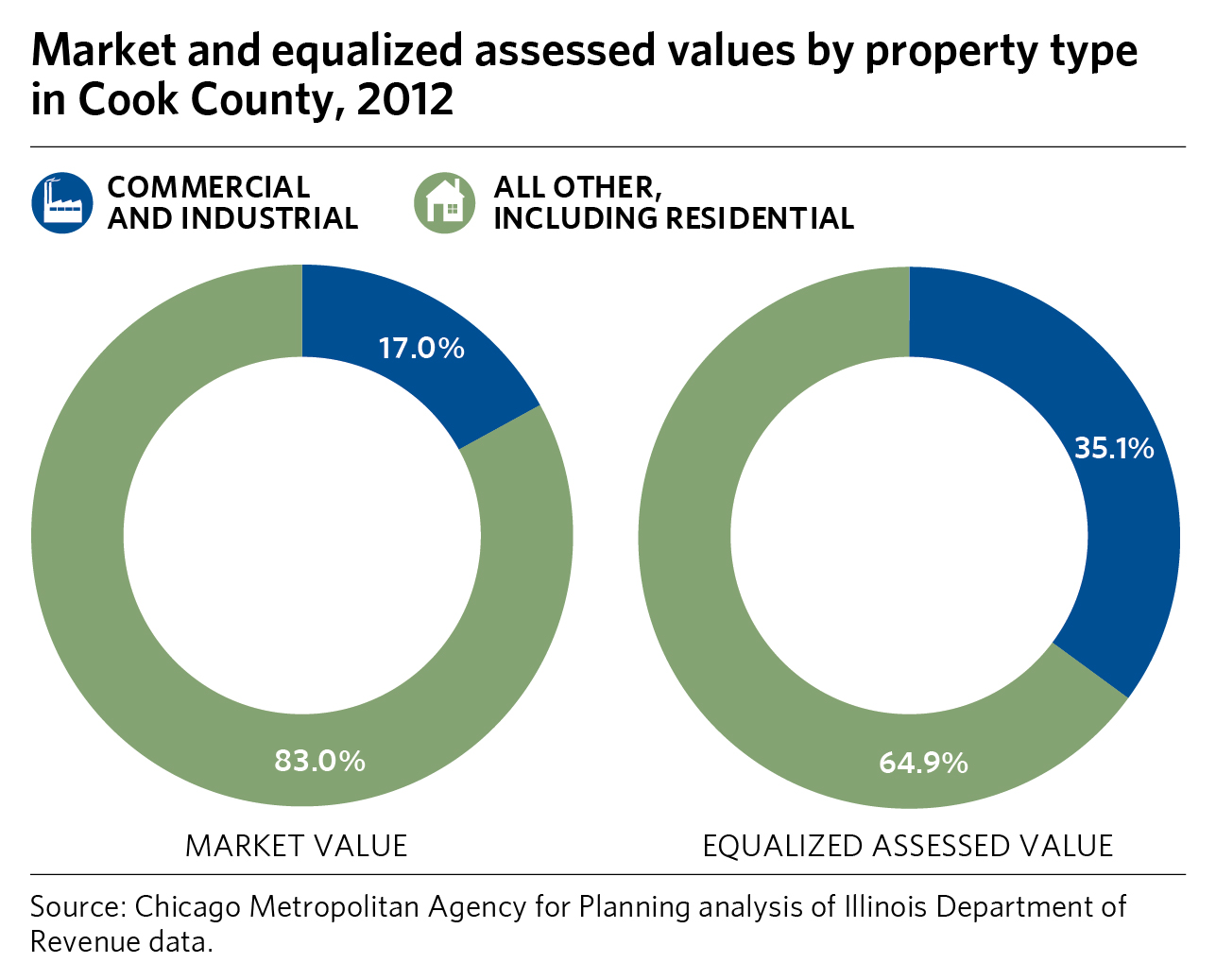

Cook County Property Tax Classification Effects On Property Tax

Cook County Property Tax Classification Effects On Property Tax

Property Tax In The United States Wikipedia

Property Tax In The United States Wikipedia

You Know Illinois Property Taxes Are Sky High But The

You Know Illinois Property Taxes Are Sky High But The

Illinois Property Tax Calculator Smartasset

Illinois Property Tax Calculator Smartasset