Dont let the high property taxes scare you away from buying a home in new jersey. When combined with relatively high statewide property values the average property tax payment in new jersey is over 7800.

New Jersey Income Tax Calculator Smartasset

New Jersey Income Tax Calculator Smartasset

how are nj property taxes calculated

how are nj property taxes calculated is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how are nj property taxes calculated content depends on the source site. We hope you do not use it for commercial purposes.

Learn how your property taxes are calculated based on the assessed value of your home.

How are nj property taxes calculated. New jersey property tax. Because of new jerseys strong home rule concept of government the state does not participate in the making of local budgets nor does it receive any of the property taxes collected. Sweeney proposal to lift cap was calculated move.

These taxes on a persons possessions are called personal property taxes and are usually calculated differently than the home property taxes above. An individuals property taxes are then calculated by multiplying that general tax rate by the assessed value of his particular property. Our new jersey property tax calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in new jersey and across the entire united states.

Level range is permitted and is calculated at 15 above to 15 below the common level or average ratio. All real property is assessed in new jersey according to the same standard of value except for qualified agricultural or horticultural land. New jersey has the highest property taxes in the country.

In nearly half of new jerseys counties real estate taxes for the average homeowner are. Property taxes are calculated using the value of the property. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The average effective property tax rate is 244 which means that on average homeowners in new jersey pay almost 250 of their home value in property taxes each year. This includes both the land and the buildings on it. Nj senate president steve sweeneys idea to lift the property tax cap idea was done with him first strapping on a parachute.

Residential property taxes are calculated annually for the purpose of raising tax revenue for new jerseys local governments including the county municipality and school district. Every one to five years tax assessors will value the property and charge the. Learn how your property taxes are calculated based on the assessed value of your home.

During an appeal once the hearing body determines the true value the. The average effective property tax rate in new jersey is 244 compared with a national average of 108. New jerseys real property tax is ad.

In addition to the property tax that most people are familiar with for homes and real estate there can sometimes be other forms of property tax for other forms of property. Building codes taxes assessed.

Nj Income Tax Important Changes For 2018

Nj Income Tax Important Changes For 2018

Http Njpropertytaxguide Com Njcpa Property Tax Guide Brochure Low Pdf

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

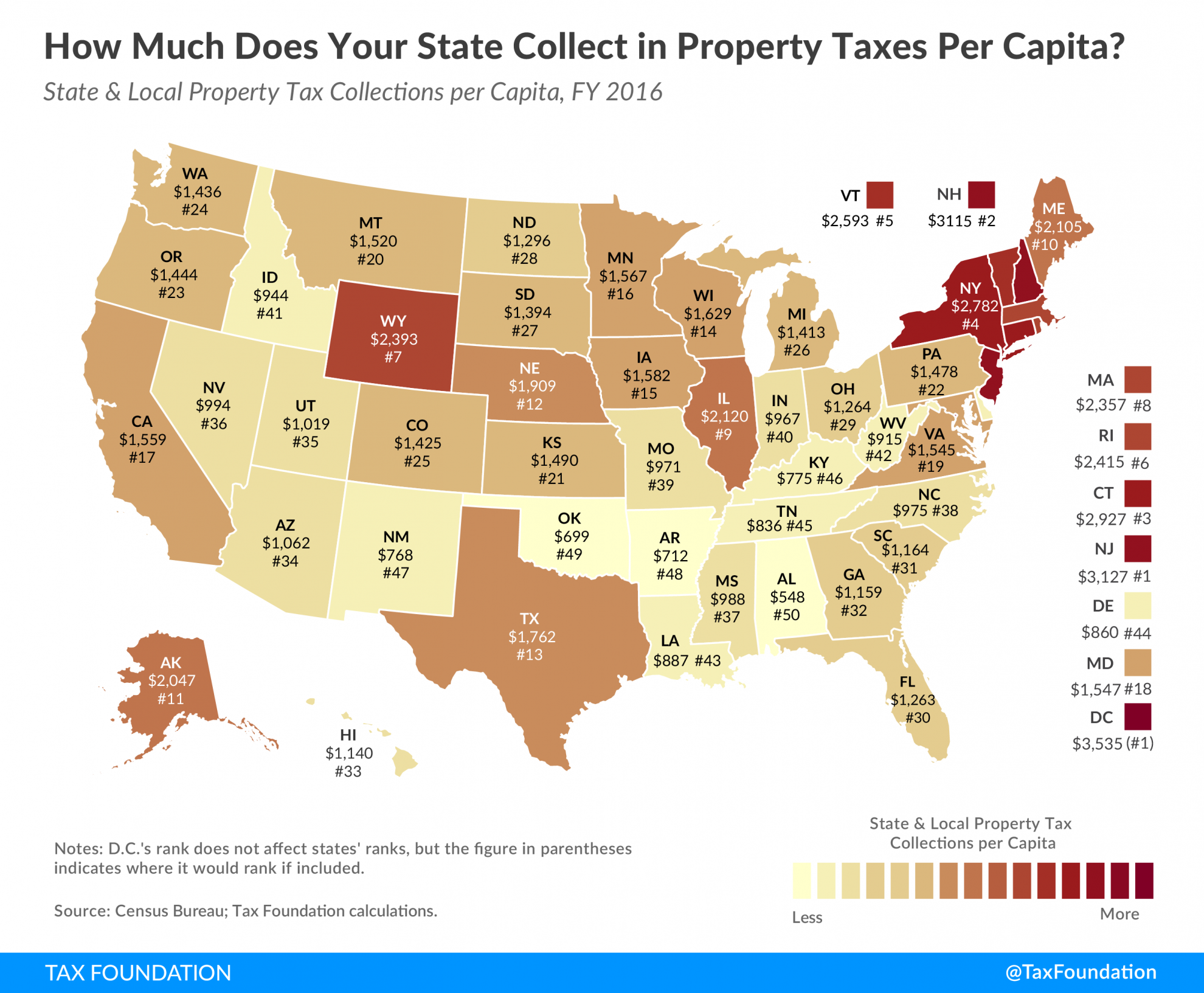

Property Taxes Per Capita State And Local Property Tax Collections

Property Taxes Per Capita State And Local Property Tax Collections

Property Tax 201 Equalization Ratio Civic Parent

Property Tax 201 Equalization Ratio Civic Parent

Ana Monroy S Blog Want To Appeal Your Nj Property Taxes Don T Delay

Web Guide To Nj Property Taxes Everything Except Why They Re So

Web Guide To Nj Property Taxes Everything Except Why They Re So

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Do Nj Homeowners Pay Too Much Rutgers Center For Real Estate

Do Nj Homeowners Pay Too Much Rutgers Center For Real Estate

2018 Tax Total Tax Table Moorestown Township Nj Official Website

How Are My Property Taxes Calculated