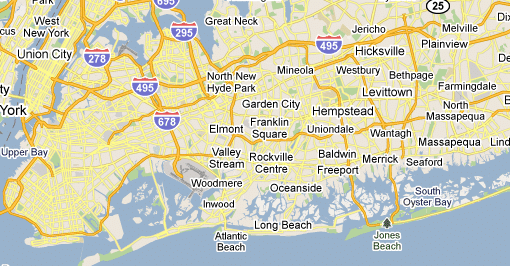

The town places a value on every property. The tentative roll for the 2020 21 tax year was published wednesday and now nassau county taxpayers can start challenging their assessments.

Nassau County Archives The Roosevelt Field Agency

Nassau County Archives The Roosevelt Field Agency

file property tax grievance nassau county

file property tax grievance nassau county is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in file property tax grievance nassau county content depends on the source site. We hope you do not use it for commercial purposes.

Our online form is completely safe and risk free.

File property tax grievance nassau county. Nassau county tax grievance nassau county property tax appealing form service 516 342 4849. Ie 600000 if we can prove your home is worth less than that value we will accept your grievance. Nassau county assessment review dates.

Message from george maragos nassau county comptroller. How to file a tax grievance. If your property is located in a village that assesses property you will have two assessments one for the village and one for the town.

How to appeal your assessment at the request of nassau county executive laura curran arc has agreed to provide a grace period for filing a grievance until thursday april 2 2020. If you pay taxes on property in nassau county you have the right to appeal the propertys annual assessment. The online form is only available between september and march for nassau county or between september and may for suffolk county.

Nassau county residents should file a tax grievance each and every year. Arc community grievance workshops. Property tax grievance is a formal complaint filed against a towns assessed value on a particular parcel of property based upon comparable sales.

Forms instructions should i file online or on a paper form. Nassau countys official website specifically states that the assessment review commission will never increase the assessment which means that your decision to grieve your property taxes has zero risk associated with it. This is the quick and simple method for you the home owner to file an online property tax grievance.

Since your property tax bill is calculated by multiplying your property assessment x your local tax rate by not filing you are paying in some cases double what your neighbor is. This website will show you how to file a property tax grievance for you home for free. Taxpayers have until march 1 to file grievances with the c.

File the grievance form with the assessor or the board of assessment review bar in your city or town. Can i attach documents to my application form. Otherwise you are paying too much in property taxes.

Nassau county property tax grievance tutorial video revised dates for filing a grievanceappeal. Nassau county residents contact the nassau county assessment review commission 516 571 3214. Use ar3 if you disagree with the propertys tax class or exemptions.

We will show you step by step how to look up your homes value compare it to recent sales and submit your filing to the nassau county department of assessment online for free. You are not required to use an attorney to file. If i file a tax grievance nassau county tax officials will personally inspect my home.

January 2 to march 10 2017 video short cuts. Nassau counties property tax grievance deadline is march 2 2020.

How To File For A Nassau County Property Tax Grievance Your

Nassau County Grievance Filing On Property Tax Property Tax

Nassau County Grievance Filing On Property Tax Property Tax

Tax Grievance Appeal Form Nassau County New York 2020

Tax Grievance Appeal Form Nassau County New York 2020

How To File For A Nassau County Property Tax Grievance Your

Maragos All Nassau County Homeowners Should File Property Tax

Maragos All Nassau County Homeowners Should File Property Tax

Tax Grievance Appeal Form Nassau County New York 2020

Tax Grievance Appeal Form Nassau County New York 2020

Questions Raised Over Nassau County Assessment Fix Newsday

Questions Raised Over Nassau County Assessment Fix Newsday

Why All Nassau County Homeowners Should File A Tax Grievance Tax

Why All Nassau County Homeowners Should File A Tax Grievance Tax

Nc Property Tax Grievance E File Tutorial Youtube

Nc Property Tax Grievance E File Tutorial Youtube