If you want to deduct more income tax your property tax deduction goes down. Similar to where they would have been under the old tax law.

Tax Reform Impact What You Should Know For 2019 Turbotax Tax

Tax Reform Impact What You Should Know For 2019 Turbotax Tax

2018 tax law changes property tax deduction

2018 tax law changes property tax deduction is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 2018 tax law changes property tax deduction content depends on the source site. We hope you do not use it for commercial purposes.

Taxpayers who are subject to the amt will typically find that their property tax deduction results in little or no reduction in their overall federal tax liability.

2018 tax law changes property tax deduction. A rush by homeowners to prepay property taxes for 2018 so they could be. However virtually all of them affect 2018 and beyond. 94 of households will claim the standard deduction in 2018.

Your complete guide to the 2018 tax changes. For qualifying property placed in service in tax years beginning after 123117 the tcja increases the maximum section 179 deduction to 1 million up from 510000 for tax years beginning in 2017. The irs unveils its changes each year including cost of.

How the new tax law will impact. A slew of updates from the irs and major tax reform passed by congress could significantly alter your situation for the 2018 tax year. There was a sweeping overhaul of us tax legislation late last year.

The tax overhaul temporarily lowered the threshold for the medical expense deduction. How the new tax law affects homeowners. Some of the best news from the tax reform law was an increase in the standard deduction.

For 2018 2025 the tcja changes the deal by limiting itemized deductions. Are similar to where they would have been under the old tax law. Most of these changes in tax law dont affect the 2017 tax year.

For the 2017 and 2018 tax years youre able to claim an itemized deduction for out of pocket health care. As is the case with everything at deductionstax we endeavor to provide an executive summary and then more detail for those that want to learn more. Nearly doubled in the 2018 tax year to.

This was the case before the 2018 tax law took effect and its still the case in 2018 and going forward under the terms of the tcja. 94 of households will claim the standard deduction in 2018. Your complete guide to the 2018 tax changes.

Above average state income tax and property tax rates. The new law roughly doubles the standard deduction to 12000 for an individual.

How The Tcja Tax Law Affects Your Personal Finances

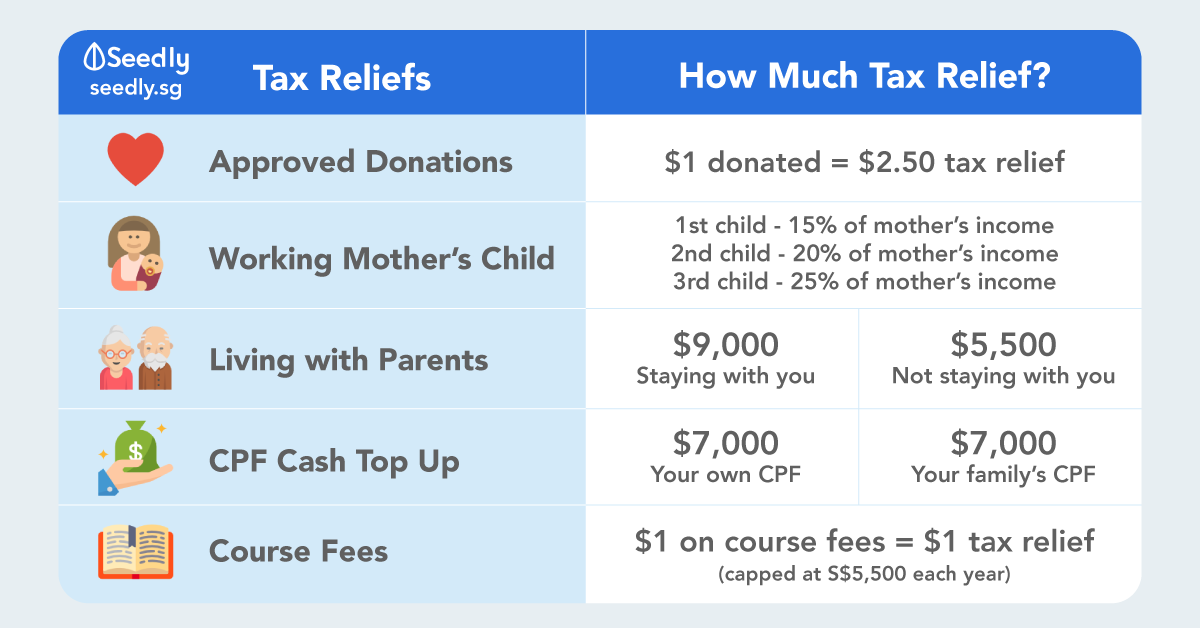

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

This Is Why Filing Your Income Tax Return Will Never Be The Same

This Is Why Filing Your Income Tax Return Will Never Be The Same

How The Tcja Tax Law Affects Your Personal Finances

Changes In The New Tax Law Trustdale Blog

Changes In The New Tax Law Trustdale Blog

Fall 2018 The Impact Of The Tax Cuts And Job Act On Family Law Cases

Tax Cuts And Jobs Act How The New Tax Bill Affects Individuals

Tax Cuts And Jobs Act How The New Tax Bill Affects Individuals

How The Tcja Tax Law Affects Your Personal Finances

Tax Deductions For Home Mortgage Interest Under Tcja

Tax Deductions For Home Mortgage Interest Under Tcja

Tax Cuts And Jobs Act Of 2017 Wikipedia

Tax Cuts And Jobs Act Of 2017 Wikipedia

How Does The Deduction For State And Local Taxes Work Tax

How Does The Deduction For State And Local Taxes Work Tax