Beginning in taxable year 2015 which is payable in 2016 veterans with a service connected disability rating of at least 30 can apply to have their dwellings assessed value reduced. Many states offer exemptions solely for disabled veterans.

All Veteran Property Tax Exemptions By State And Disability Rating

All Veteran Property Tax Exemptions By State And Disability Rating

illinois property tax exemption for disabled veterans

illinois property tax exemption for disabled veterans is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in illinois property tax exemption for disabled veterans content depends on the source site. We hope you do not use it for commercial purposes.

2 spouse or unmarried surviving spouse as their primary residence.

Illinois property tax exemption for disabled veterans. Illinois veteran housing benefits. In 2015 senate bill 107 expanded the illinois disabled veterans property tax exemption. This exemption applies to the tax levied by each county to the owner of a mobile home that meet all of the following criteria.

Senate bill 107 sb 107 provides tax relief for disabled veterans. Surviving spouses who have not remarried are also eligible. This bill sailed through the illinois house and senate without opposition.

Vermont property tax exemption. For information on how to apply for property tax relief available through homestead exemptions contact your chief county assessment office. 30 49 can qualify for a 2500 eav reduction.

A new law in illinois is increasing relief of property tax for disabled illinois military veterans. The state of illinois runs 4 veterans homes in anna lasalle manteno and quincy. California for instance allows qualified disabled veterans to receive a property tax exemption on the first 196262 of their primary residence if their total household income does not exceed 40000 and the veteran is 100 percent disabled as a result of service.

This annual exemption reduces the equalized assessed value eav of a disabled veterans home likely lowering the total tax bill. Illinois veterans or their spouses should contact their local veteran service officer for information to apply for the specially adapted housing property tax and mobile home tax exemption benefits. 1 mobile home must be owned and used exclusively by a disabled veteran.

The law expands eligibility for the disabled veterans standard homestead exemption for united. Veterans property tax exemption illinois. The state of illinois provides several veteran benefits.

Property tax homestead exemptions and mobile home exemptions helping more illinois veterans with disabilities and their families. Veterans and their spouses who qualified for the specially adapted housing exemption for veterans with disabilities 35 ilcs 20015 165 for the 2014 tax year will receive additional property tax relief on their. By steven a leahy.

Veterans with a certified disability of. This page explains them. Veterans are exempt from the full amount of the mobile home tax.

Va rated disabled veterans in vermont who are rated at least 50 disabled may qualify for a property tax exemption of at least 10000 on a primary residence. Finally illinois legislators proposed a bill that i think everyone can agree. The actual amount of the exemption may not exceed 40000 and there may be different levels of exemption depending on location.

50 69 can qualify for 5000 eav reduction.

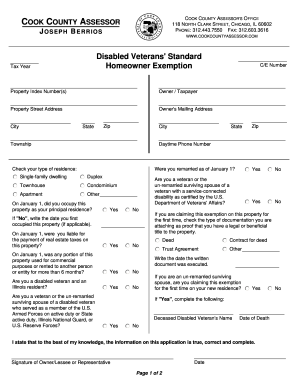

Disabled Veterans Standard Homeowner Exemption Cook County

Disabled Veterans Standard Homeowner Exemption Cook County

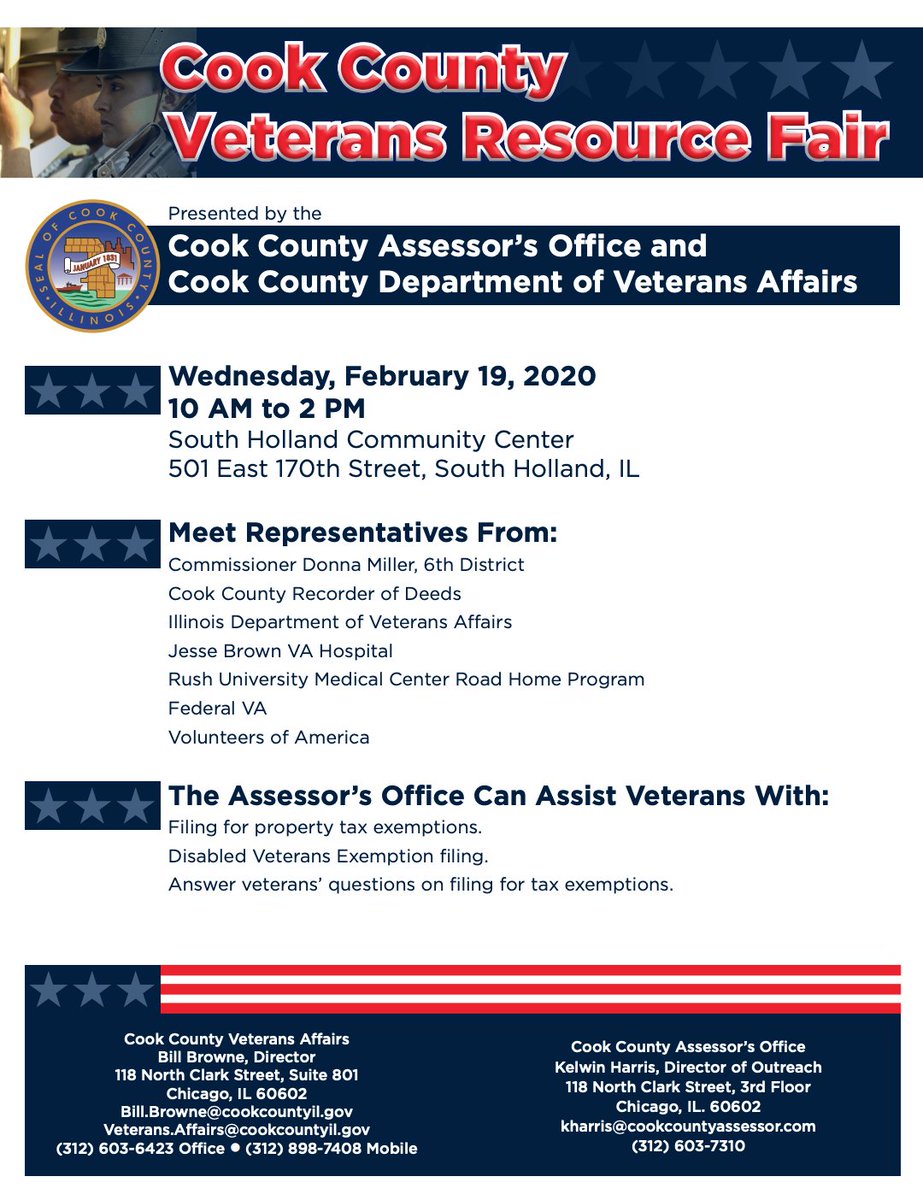

Robin Kelly On Twitter Attend The Cook County Veterans Resource

Robin Kelly On Twitter Attend The Cook County Veterans Resource

Disabled Veterans Property Tax Exemptions By State

Veteran Property Tax Exemptions Illinois Indiana Skyward

Veteran Property Tax Exemptions Illinois Indiana Skyward

New Law Ensures Year Round Property Tax Relief For Disabled

New Law Ensures Year Round Property Tax Relief For Disabled

Problem With Lake County Property Tax Bill Problems Identified

Disabled Veterans Can Learn About Tax Exemptions At February

Disabled Veterans Can Learn About Tax Exemptions At February

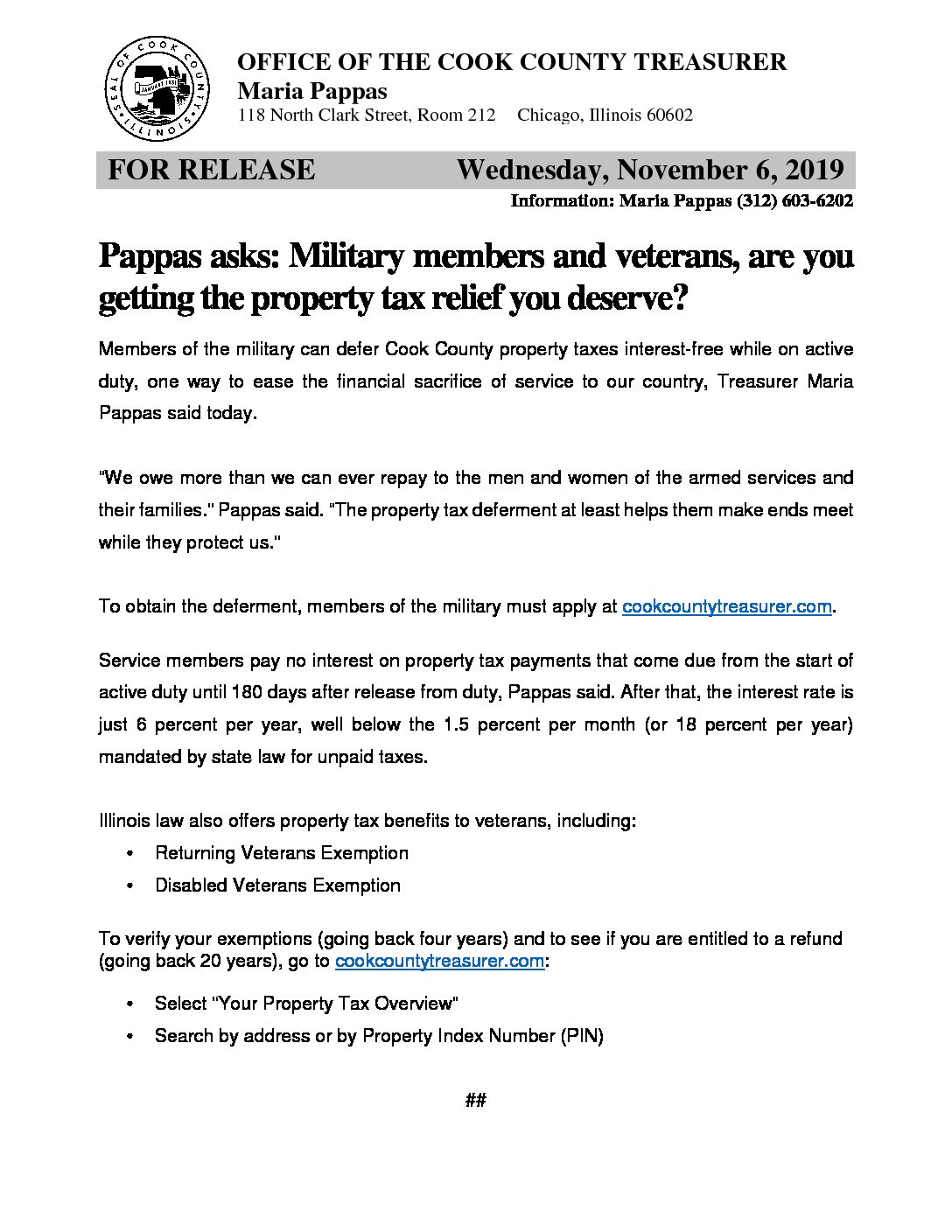

Property Tax Relief For Military Members State Representative

Property Tax Relief For Military Members State Representative

Property Tax Breaks For Disabled Veterans

Property Tax Breaks For Disabled Veterans

C E Number Fill Online Printable Fillable Blank Pdffiller

C E Number Fill Online Printable Fillable Blank Pdffiller

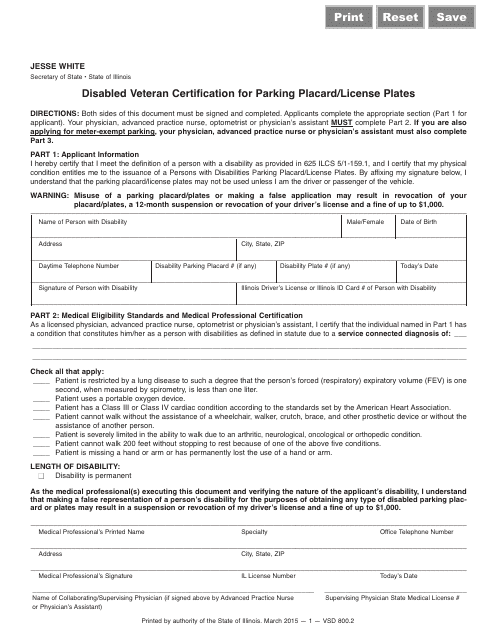

Form Vsd800 2 Download Fillable Pdf Or Fill Online Disabled

Form Vsd800 2 Download Fillable Pdf Or Fill Online Disabled