2nd half due. Online property tax payments.

natrona county property tax due dates

natrona county property tax due dates is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in natrona county property tax due dates content depends on the source site. We hope you do not use it for commercial purposes.

Pay property taxes online.

Natrona county property tax due dates. Property tax notices are typically generated and mailed out in the month of september. Property tax payment tax. 1st half due november 10.

Property tax due dates. Value based tax property tax is an ad valorem tax which means it is based on the value of the property. This means that if you did not receive a tax bill for any reason taxes are still due and if paid late interest will be collected.

If you purchase a property or record a deed on or after january 1 you will not receive a tax bill in your name. If you pay your first half andor your second half of property tax after the due dates a penalty will be added to your tax. Welcome to natrona countys property tax payment system.

Once you have received your tax notice you may either pay the taxes in full or in two half payments. To get started please provide the following information from your tax bill and click the submit button. Taxpayers are responsible for payment of taxes regardless of billing.

Tax relief exemptions. Georgia is ranked number thirty three out of the fifty states in order of the average amount of property taxes collected. Enter the total tax due amount found on your tax bill.

Taxes tax information tax contacts tax information. The assessors office responsible for determining the market value of each property in the county which is then used to figure the taxable amount on each property. The median property tax in georgia is 134600 per year for a home worth the median value of 16280000.

Some accounts due to their status may require the taxpayer to contact the treasurers office over the phone or in person to pay their. Counties in georgia collect an average of 083 of a propertys assesed fair market value as property tax per year. Harrison township taxpayers bill of rights disclosure statement attachment 1 harrison township taxpayers bill of rights disclosure statement attachment 2 harrison township taxpayers bill of rights disclosure statement attachment 3 harrison township taxpayers bill of rights disclosure statement attachment 4 property tax rates.

First installment must be in receipt of by november 10 of the current year. Natrona county property tax payment system. Property tax payments can be made in two payments and are the same from year to year.

Second installment must be in receipt of by may 10 of the following year. The sheridan county treasurers office handles payment of property taxes and works with the property tax relief program. Welcome to our online property tax payment system before you begin you must have your property tax bill readily available in order to use this service as it contains important information necessary to complete the transaction.

If your tax is 100 or less for real property or 50 or less for personal property or manufactured homes it must be paid in full by the first installment date to avoid penalty. Learn more about the property taxes of converse county and how to pay your taxes online. View and pay sheridan county property taxes online.

Must be in receipt of by december 31 of the current year.

Online Services Natrona County Wy

Petition Natrona County School District Attendance Policy

Petition Natrona County School District Attendance Policy

Natrona County Receives 3 7m Fed Payment In Lieu Of Taxes Refund

Natrona County Receives 3 7m Fed Payment In Lieu Of Taxes Refund

Natrona County Gop Selects Candidates For Open Commission Seat

Natrona County Gop Selects Candidates For Open Commission Seat

County Receives About 150 Citizen Complaints About Property

County Receives About 150 Citizen Complaints About Property

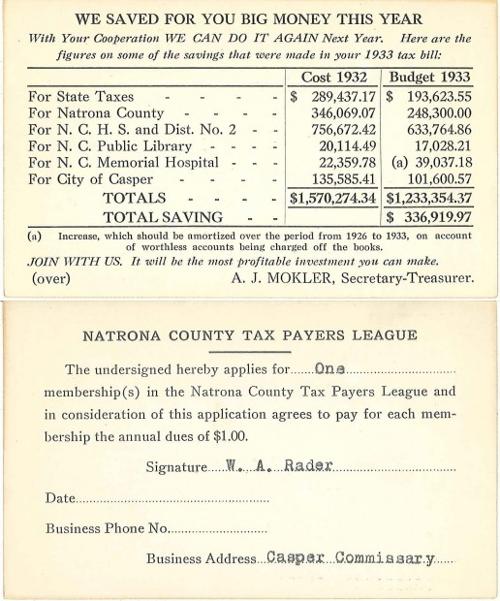

Answer Girl The Short History Of The Natrona County Tax Payers

Answer Girl The Short History Of The Natrona County Tax Payers

Expanded Foreign Trade Zone Good For Natrona County Businesses

Expanded Foreign Trade Zone Good For Natrona County Businesses

Property Appraisals In Natrona County Appealed At Higher Rate Than

Property Appraisals In Natrona County Appealed At Higher Rate Than

Fillable Online Natrona County Conservation District Fax Email

Fillable Online Natrona County Conservation District Fax Email