The city makes no warranties expressed or implied concerning the accuracy completeness reliability or suitability of this information for. Local property taxes make up the difference.

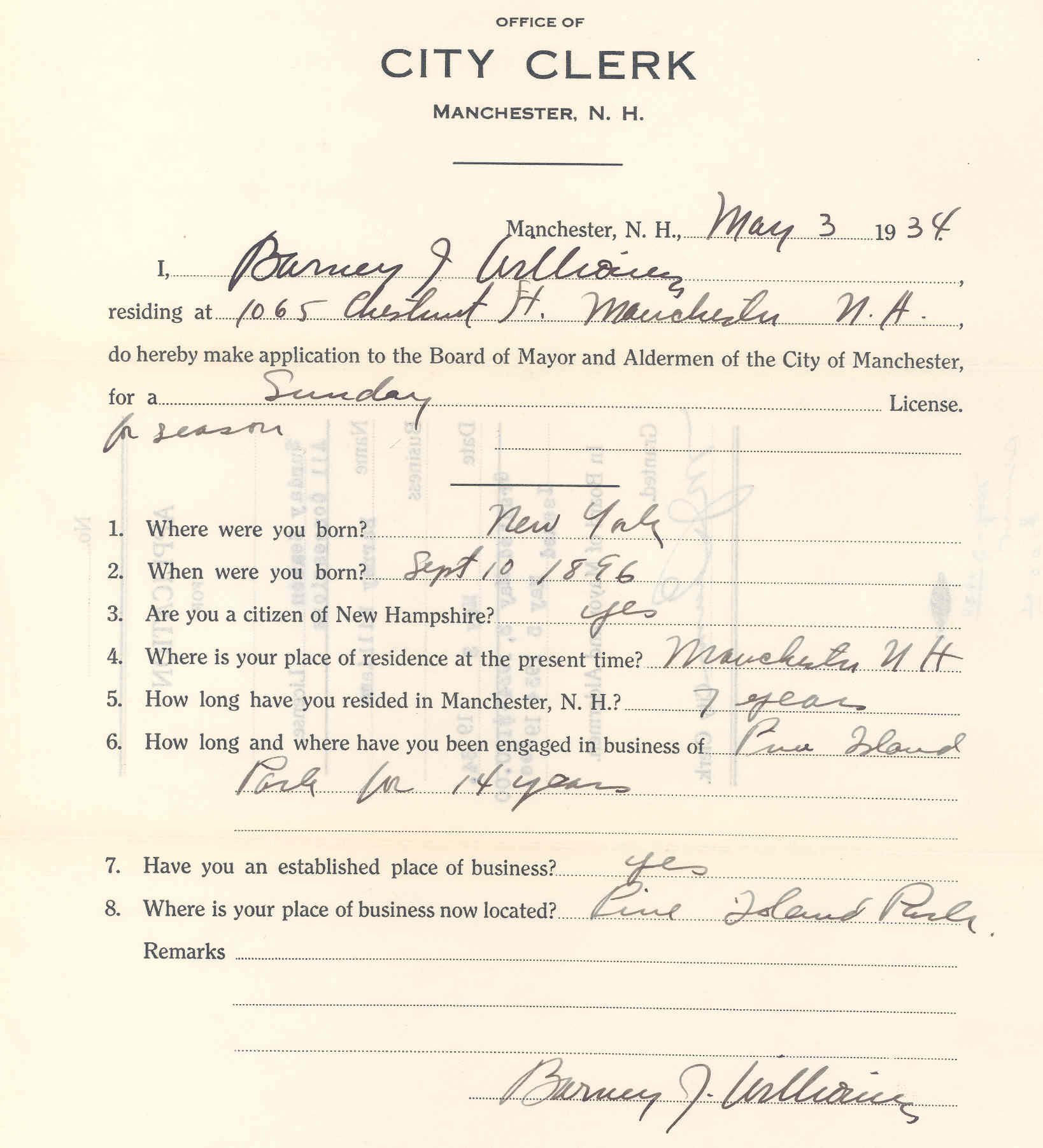

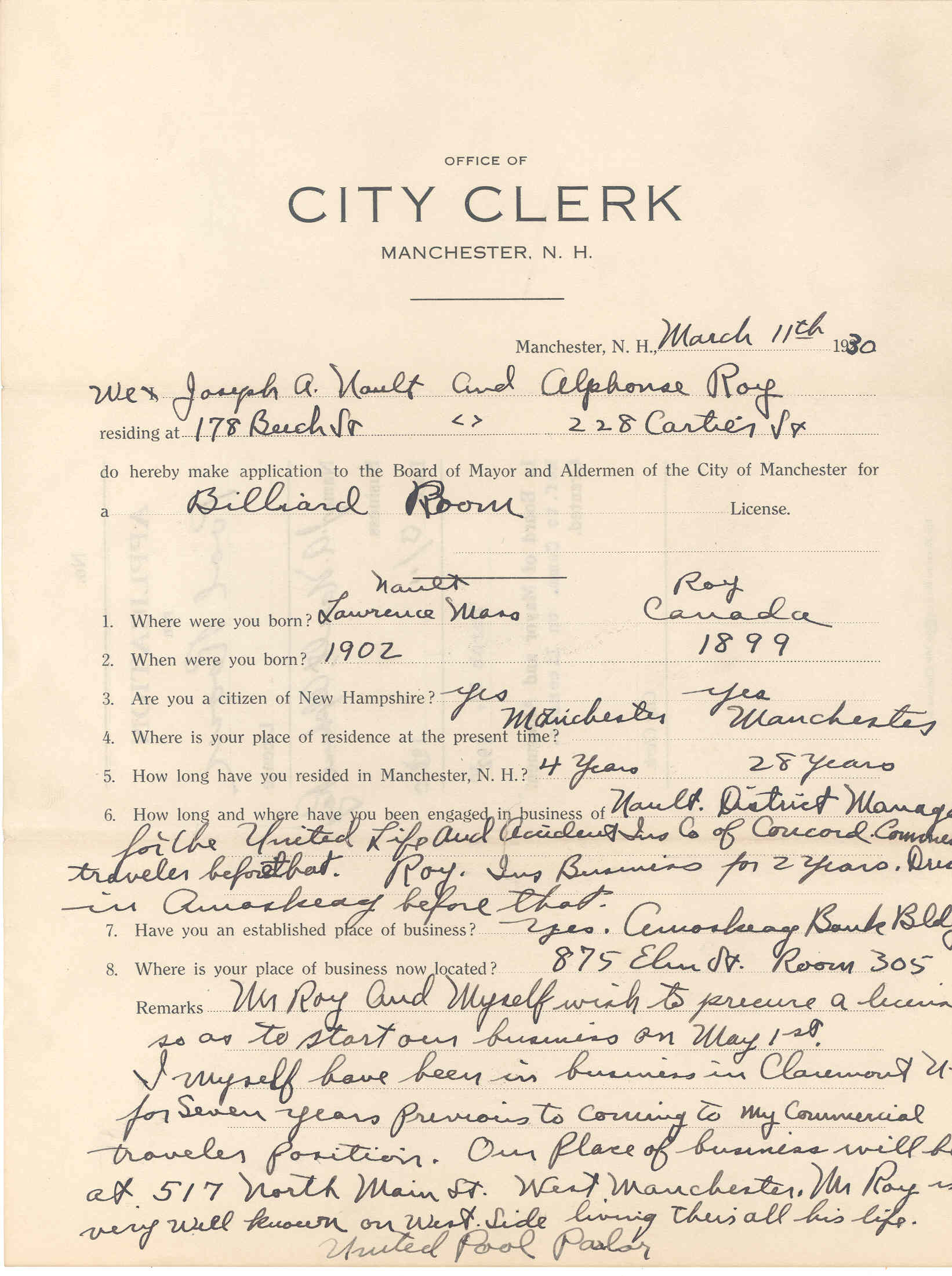

City Matters A Dirty Way To Beat Taxes Property Owner Piles Up

City Matters A Dirty Way To Beat Taxes Property Owner Piles Up

city of manchester nh property taxes

city of manchester nh property taxes is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in city of manchester nh property taxes content depends on the source site. We hope you do not use it for commercial purposes.

Some properties may also have additional tax accounts for other types of taxes assessed or owed.

City of manchester nh property taxes. The information furnished on this site is for the convenience of the user and is not an official public record of the city of manchester nh the city. The property tax bills are mailed out twice a year to property owners. It is provided as a service to the general public.

In late october due december 1 and again in mid april due june 1. Each tax account has a unique account id and is separate with respect to amounts billed owed and paid. Property tax rates vary widely across new hampshire which can be confusing to house hunters.

The city of manchester tax application also gives citizens a way to pay property taxes online using ach debit or credit card. Meals and rooms operators. New hampshires statewide property tax is dedicated to education funding.

Make an online payment the city of manchester nh tax collectors office is responsible for the collection of the following. In claremont for example the property tax rate is 41 per 1000 of assessed value while in auburn its only around 21 per 1000 of assessed value. The city clerktax collection office accepts all payments for property taxes.

Chapter 28 of the special session laws of 1982 regulates the collection of property taxes. However those statewide property taxes are not enough to cover each towns public education costs. Welcome to the city of manchester tax billing.

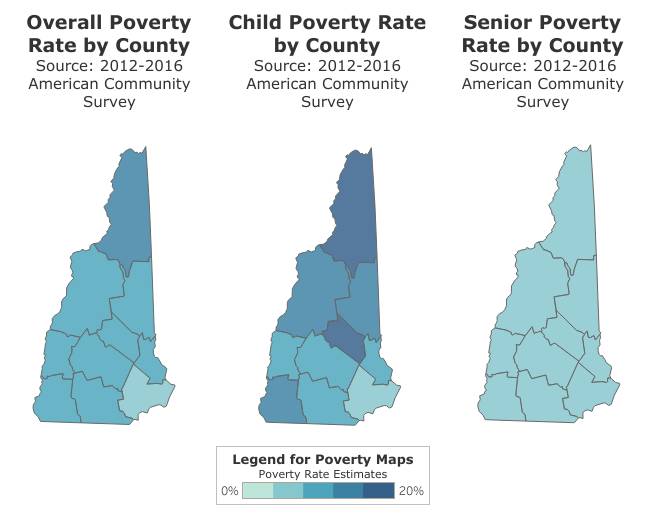

Taxpayers are able to access property tax rates and related data that are published annually which is provided by the new hampshire department of revenue administration. Each property in the city will have a real estate tax account. New hampshires median income is 73159 per year so the median yearly property tax paid by new hampshire residents amounts to approximately of their yearly income.

New hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. Enable users to access property tax accounts property assessment information and related account activity. Tax rates for manchester nh.

2337 the property tax rate shown here is the rate per 1000 of home value. 000 the total of all income taxes for an area including state county and local taxesfederal income taxes are not included property tax rate. Learn more about property taxes in nh and which towns have the lowest and highest property tax rates.

Online payments for taxes and moter vehicle registrations can be made by using our online payment portal. Property taxes are assessed april 1. 000 the total of all sales taxes for an area including state county and local taxesincome taxes.

City Budget 101 Understanding Manchester S Tax Cap Manchester

City Budget 101 Understanding Manchester S Tax Cap Manchester

How Much Does It Cost To Live In Manchester Nh

How Much Does It Cost To Live In Manchester Nh

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin

Measuring New Hampshire S Municipalities Economic Disparities And

Measuring New Hampshire S Municipalities Economic Disparities And

City Hall Manchester New Hampshire Wikipedia

City Hall Manchester New Hampshire Wikipedia

City Budget 101 Understanding Manchester S Tax Cap Manchester

City Budget 101 Understanding Manchester S Tax Cap Manchester