Even if you still owe on the property it is possible to take a second lien on the property. Hire a real estate lawyer in any and all cases of carrying a note for your purchaser and in concluding the sale.

Should I Agree To Carry The Note On The Sale Of Property

Should I Agree To Carry The Note On The Sale Of Property

carrying a note on a property

carrying a note on a property is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in carrying a note on a property content depends on the source site. We hope you do not use it for commercial purposes.

If you have lived in the property long enough to build some equity and you get a good down payment you may be able to pay the remainder of the loan in full.

Carrying a note on a property. If you own the property free and clear of liens owner financing is much easier. Examples of carrying amount. While a residential mortgage loan is the most common type of financing used to purchase a home owner financing is an alternative that has advantages and disadvantages for both buyers and sellers.

Because you have owned the property that is securing your note you know what youre getting into. This is an important calculation to figure before carrying back the note. Carrying amount also known as carrying value is the cost of an asset less accumulated depreciation.

Ias 16 does not prescribe the unit of measure for recognition what constitutes an item of property plant and equipment. If you had to take the property back its unlikely that you would have any huge surprises. You know its strengths and its weaknesses.

Your note is secured by a property you understand and whose value you know. Ias 169 note however that if the cost model is used see below each part of an item of property plant and equipment with a cost that is significant in relation to the total cost of the item must be depreciated. You would take a first lien on the property to secure the note payable to you.

The carrying amount is usually not included on the balance sheet as it must be calculated. Whatever money it costs in the short run is more than made up for in the long. Do you own the property outright.

This is usually used in cases for borrowers that may have a hard time obtaining traditional financing. Owner will carry note means the owner mortgages the property to you and you pay your monthly payment directly to them. The term carrying amount is also known as book value or carrying valuethe term carrying amount is often used when there is a valuation account associated with another general ledger account.

Too many questions about this kind of financing need answers and a lawyer and professional real estate agent will be valuable. Paying taxes isnt fun but there are strategies you can employ to cut your tax bill. Should you carry the note on the sale of your property.

Definition of carrying amount. If youre trying to avoid capital gains taxes on the sale of your home your financial planner might have. The advantage for the seller is that they actually get to sell the property.

What is the carrying amount.

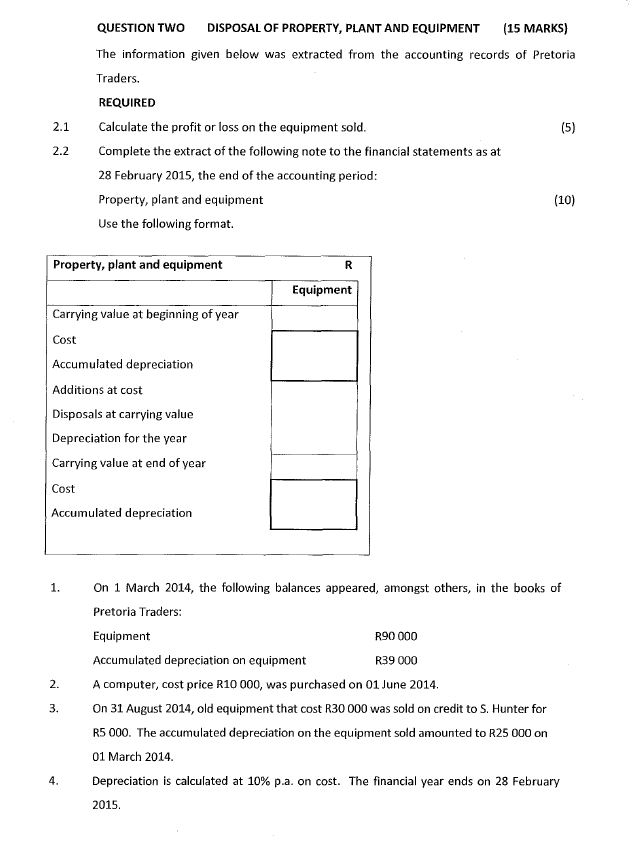

Solved Question Two Disposal Of Property Plant And Equip

Solved Question Two Disposal Of Property Plant And Equip

Notes To The Account For Investment Property By Rohnlaing96 Issuu

Notes To The Account For Investment Property By Rohnlaing96 Issuu

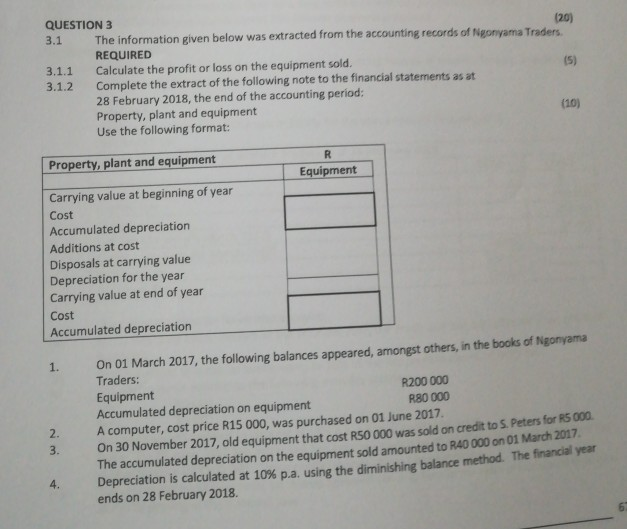

Solved Question 3 3 1 The Information Given Below Was Ext

Solved Question 3 3 1 The Information Given Below Was Ext

Property Plant And Equipment Ppe Property Plant And Equipment

Property Plant And Equipment Ppe Property Plant And Equipment

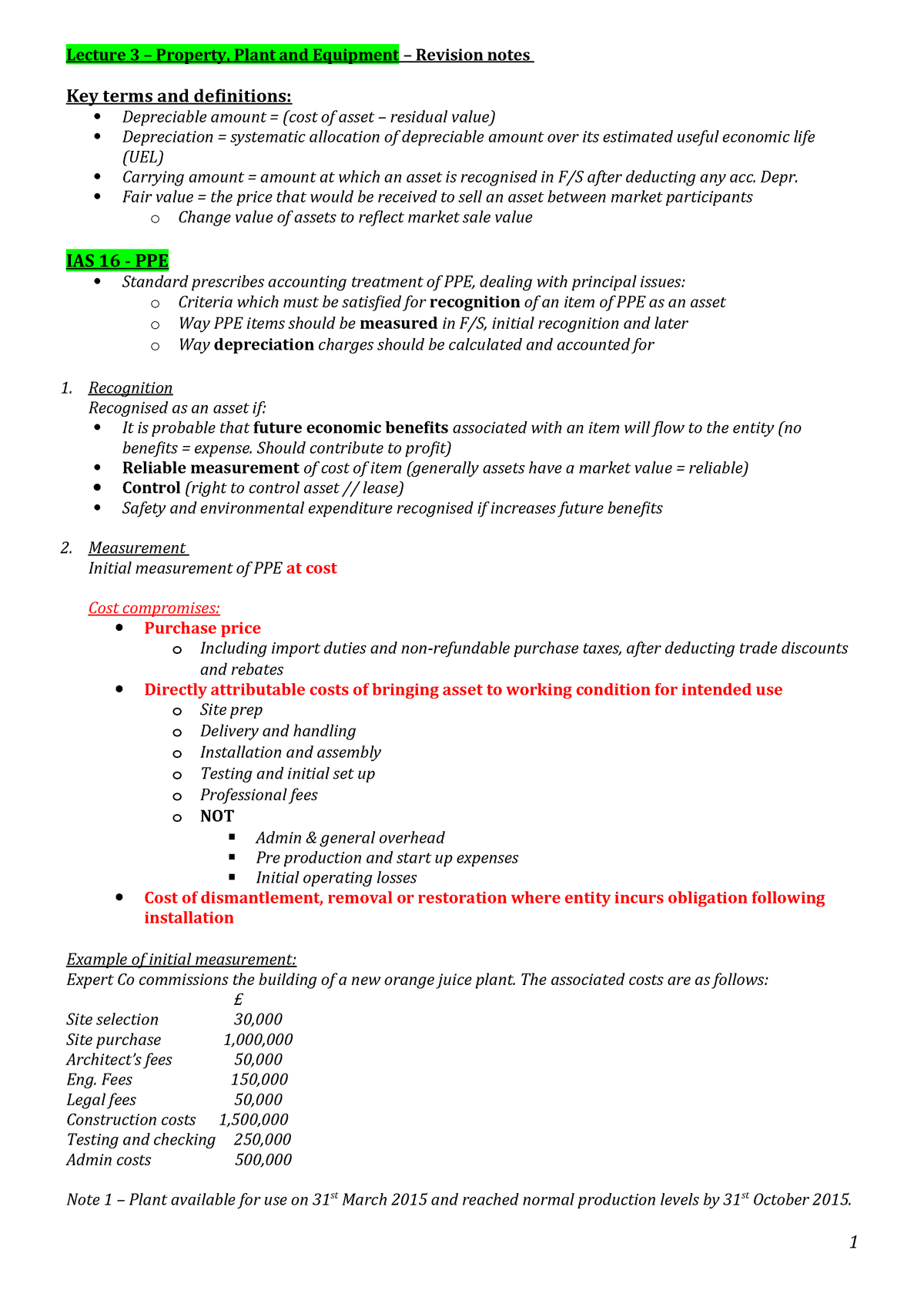

Lecture 3 Rev Notes Financial Reporting And Accounting Studocu

Lecture 3 Rev Notes Financial Reporting And Accounting Studocu

Writing Note Showing Property Tax Business Concept For Bills

Writing Note Showing Property Tax Business Concept For Bills

Writing Note Showing Commercial Real Estate Business Photo

Writing Note Showing Commercial Real Estate Business Photo

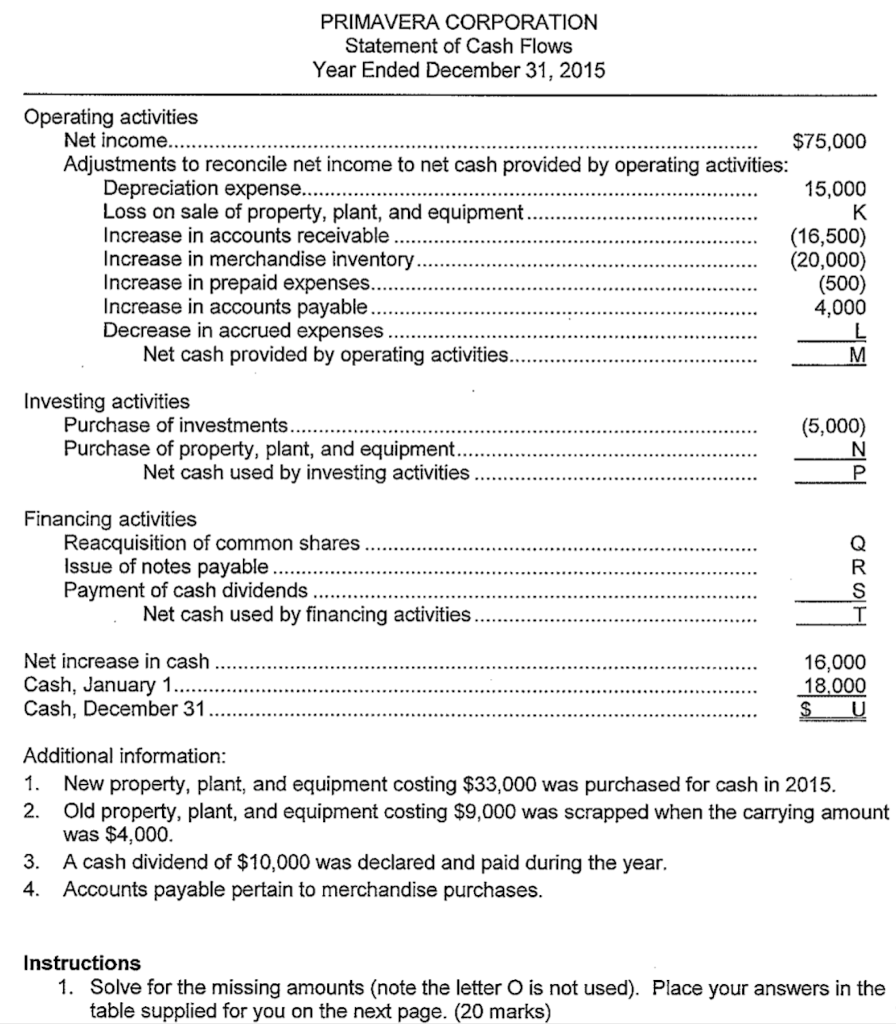

Solved Please Solve For The Missing Values In The Stateme

Solved Please Solve For The Missing Values In The Stateme

_1481631320_584fe658e5208_219279-4.jpg) Accounting Standard And General Notes For Commerce Students Notes

Accounting Standard And General Notes For Commerce Students Notes

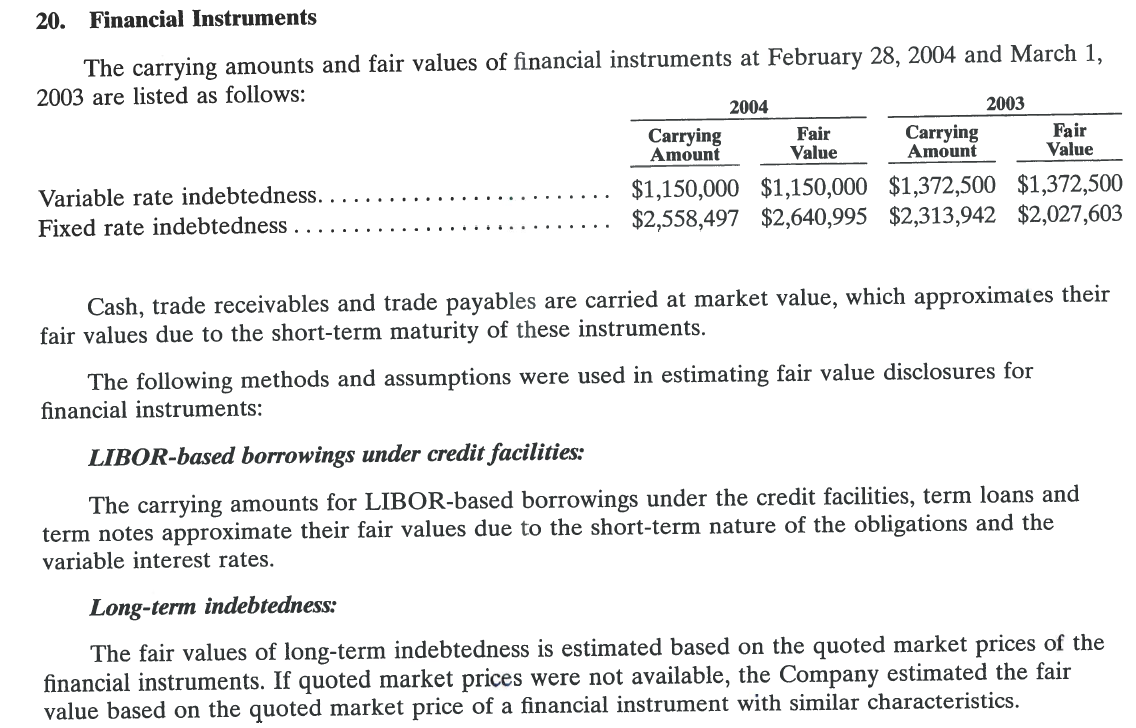

Answered Refer To Note 20 Financial Bartleby

Answered Refer To Note 20 Financial Bartleby