To estimate the federal capital gains taxes payable on the sale taxpayers must know the estimated selling price of the property and the estimated selling costs and must be able to calculate the basis or tax cost of the property. The cost base of a cgt asset is largely what you paid for it together with some other costs associated with acquiring holding and disposing of it.

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

calculating capital gains tax on commercial property

calculating capital gains tax on commercial property is important information with HD images sourced from all websites in the world. Download this image for free by clicking "download button" below. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in calculating capital gains tax on commercial property content depends on the source site. We hope you do not use it for commercial purposes.

A shop or showroom.

Calculating capital gains tax on commercial property. Use this calculator to find out whether you will have to pay cgt and how much it could cost you. I have read many articles and expert advices on the sale of house property but i am unable to find anything related to commercial property. The irs requires you to calculate capital gains because you must pay income tax on them.

Work out your gain and pay your tax on buy to let business agricultural and inherited properties. Selling a home or property. Working out your capital gain for most cgt events your capital gain is the difference between your capital proceeds and the cost base of your cgt asset.

The amount of tax you pay on capital gains depends on your tax bracket in 2015 this rate will change as tax bracket rates change. Because the lower the adjusted basis on your real estate the more capital gains tax you will have to pay when you sell or are foreclosed on. Not only is a lot of information required but it is all subject to arcane and ever changing tax laws.

Capital gains tax calculator. Calculating the correct tax basis for your commercial income property is essential for avoiding higher capital gains taxes when a property is sold. The tax rate on capital gains is less than the tax rate on wages per bracket.

Other alternatives out there to avoid this huge double tax hit if you contemplate selling or face a forced sale of your commercial property. A capital asset is an investment or piece of real estate. Be aware that there are many adjustments rules exceptions and special cases in the tax code.

Capital gains tax when you sell a property thats not your home. Calculating your basis at time of acquisition. All capital gains must be reported.

However many investors dont realize that determining tax basis is also important before you sell a property since a propertys tax basis also plays a role in determining depreciation. In the united states individuals selling selling investment real estate typically pay capital gains taxes on the sale of the property. Fortunately this capital gains tax calculator makes it easy to organize the data and complete the math.

Hi i have a a query regarding the long term capital gain tax on sale of a commercial property eg. For property sold the gain is calculated as the difference between what was paid for the asset known as the basis and what what received for it when it was sold known as the amount realized. Calculating your capital gains tax can be complicated.

Depending on your taxable income you may have to pay capital gains tax on the sale.

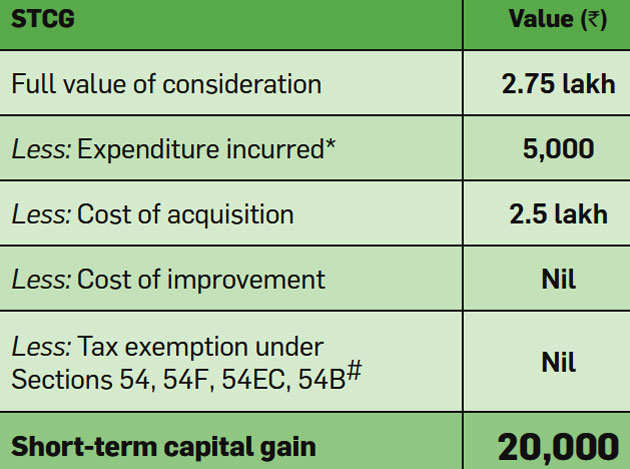

Capital Gain How To Calculate Short Term And Long Term Capital

Capital Gain How To Calculate Short Term And Long Term Capital

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Tax Payable On The Sale Of Your Rental Properties

How To Calculate Tax Payable On The Sale Of Your Rental Properties

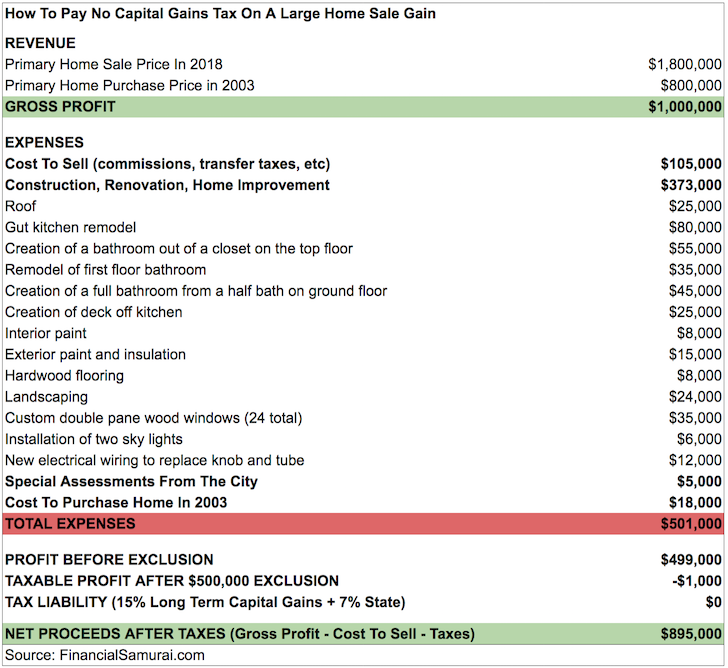

How To Pay No Capital Gains Tax After Selling Your House For Big

How To Pay No Capital Gains Tax After Selling Your House For Big

Real Property Gains Tax Rpgt In Malaysia

Real Property Gains Tax Rpgt In Malaysia

Three Different Routes To Save Tax On Long Term Capital Gains

Three Different Routes To Save Tax On Long Term Capital Gains

Capital Gains Calculator For Property In Excel

Capital Gains Calculator For Property In Excel

What Is Real Property Gains Tax Rpgt In Malaysia How To

What Is Real Property Gains Tax Rpgt In Malaysia How To